25 Best Instant Loan Apps in the UAE to Check Out (2026)

16 January, 2026

Life in the UAE is fast-paced, and money needs can come up without warning. It could be an emergency expense, a sudden travel plan, or simply not having enough cash until your next salary. In the past, getting a personal loan usually meant visiting a bank, submitting many documents, and waiting days or even weeks for approval.

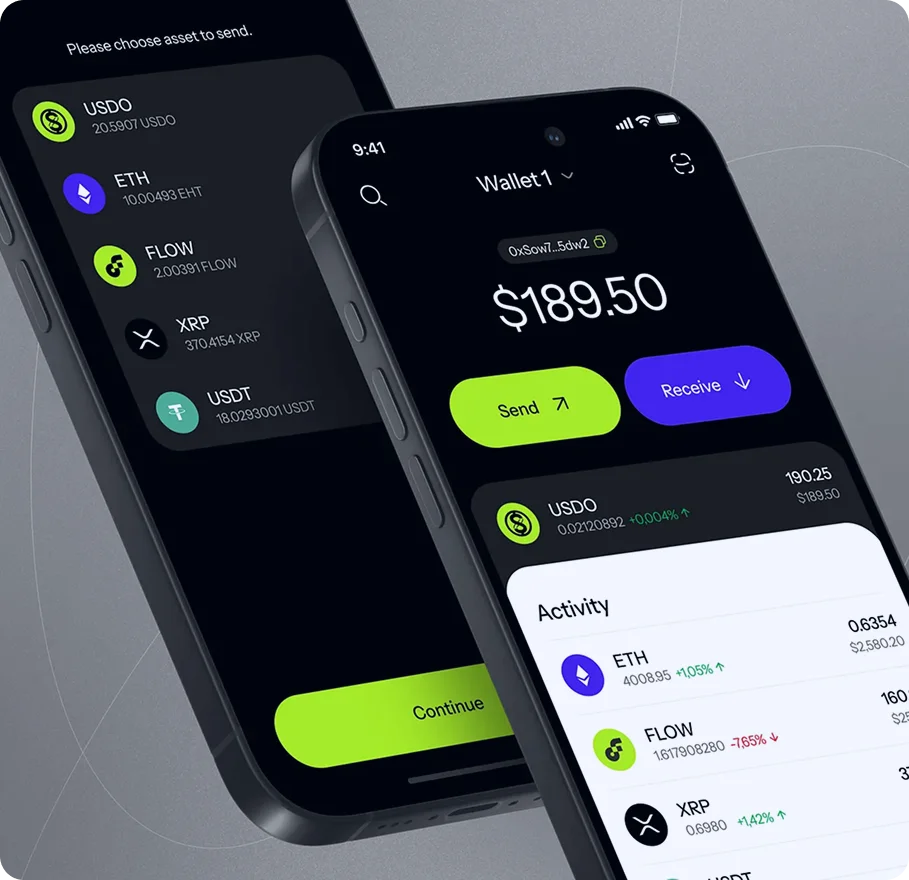

Today, things are much easier. With the growth of digital banking and fintech services, loans are now just a few taps away. Instant loan apps in the UAE allow residents and expats to apply directly from their mobile phones and receive money quickly sometimes within minutes.

These apps are popular because they are simple and clear. Instead of long approval processes, many quick loan apps in the UAE use online verification, salary-based access, and smart technology to check eligibility. This helps salaried workers, business owners, and freelancers get short-term financial support without stress or delays.

Another key reason for their popularity is convenience. People in Dubai, Abu Dhabi, and other Emirates prefer flexible financial solutions that fit their busy lifestyles. Digital banks and fintech companies now offer personal loan apps in the UAE that are easy to use, safe, and designed for everyday needs. Some instant cash loan apps in the UAE even send money to your bank account on the same day.

In this blog, we will explore the top 25 instant loan apps in the UAE. We’ll break down:

- What sets the top 25 apps apart from the rest

- Advantages and disadvantages

- Which apps are best for different types of borrowers

From well-known banks like Emirates NBD and Liv to modern fintech platforms such as Beehive, FlexxPay, and NowMoney, these apps are changing how people borrow money across the UAE.

What Are Instant Loan Apps and How Do They Work?

Instant loan apps in the UAE are mobile applications that help people get short-term or personal loans quickly and easily. These apps remove the need for long paperwork and repeated bank visits. They are built for speed and convenience, which makes them a popular choice for salaried workers, business owners, and expatriates living in Dubai and other Emirates.

Unlike traditional bank loans, where the process can take days or weeks, online loan apps in the UAE work fully through your smartphone. The steps are simple:

- Download the app

- Create an account

- Enter your basic personal and income details

- Upload required documents such as your Emirates ID.

All the information is checked by the system digitally. Many instant loan apps use smart technology to review your profile and assess eligibility. This helps speed up approvals without complex procedures.

Once your loan is approved, the money is sent directly to your bank account sometimes within minutes and usually on the same day.

Because of this fast process, instant cash loan apps in the UAE are ideal for urgent needs such as medical emergencies, school expenses, or sudden travel plans. They offer a quick and stress-free way to access funds when you need them most.

Also Read: Looking to earn extra income? Check out our blog on the top 25 trusted money-earning apps in the UAE.

How Instant Loan Apps Work: Simple Steps

1. Install and Sign Up

Start by downloading the loan app on your phone. Create an account using your Emirates ID, mobile number, and basic bank details.

2. Apply for a Loan

Select the loan amount you need and choose a repayment period based on the options shown in the app.

3. Digital Verification

The app checks your identity and income details through an online verification process, without the need for physical documents.

4. Credit Check

Smart systems review your financial profile, such as salary information or transaction history, to see if you qualify for the loan.

5. Approval and Payment

Once approved, the loan amount is sent directly to your bank account, often within a short time.

Book a free consultation with The Hashtech, a leading mobile app development company.Looking for a high-quality mobile app?

Why People Choose Instant Loan Apps

Instant loan apps are becoming more popular in the UAE because they are easy to access and simple to use. They save people from standing in long bank lines, filling out lots of paperwork, and dealing with strict approval rules. Everything can be done online, right from a mobile phone.

Many top loan apps in Dubai are also friendly for expatriates and newcomers who may not yet have a strong credit history. This makes it easier for more people to get financial support when they need it.

Overall, personal loan apps in the UAE are changing the way people borrow money. They offer faster approvals, flexible options, and a user-focused experience. By providing quick access to funds, these apps help people handle urgent expenses without unnecessary stress or delays.

How We Chose the Best Instant Loan Apps in the UAE

Since there are many instant loan apps available in the UAE, choosing the right one can be confusing. Each app offers something different: some approve loans very quickly, others provide easier repayment options, and some are better suited for expats or people without a strong credit record.

To make things simple, we looked at the most important features that matter to users. These factors help identify reliable, safe, and user-friendly platforms. Based on this, we selected the instant loan apps in the UAE that offer the best overall experience and value for borrowers.

1. Loan Amount Options and Flexibility

When choosing an instant loan app, it’s important to check how much money you can borrow. Good loan apps in Dubai usually offer different loan amounts, so you can pick what fits your situation. This could be a small amount for an urgent expense or a higher amount for bigger personal needs.

Repayment flexibility also matters. The best apps let you choose a repayment period that suits your budget, whether you want to pay back quickly or spread the payments over a longer time. This makes managing the loan easier and more comfortable.

2. Interest Rates and Extra Charges

Ease of use is important, but the cost of the loan is just as important. Reliable instant loan apps clearly show their interest rates and any service or processing fees before you apply.

A trustworthy online loan app in the UAE avoids hidden costs and explains all charges in simple terms. This transparency helps borrowers understand exactly how much they need to repay and plan their finances without surprises.

3. Approval Time and Fund Transfer Speed

One of the main reasons people use instant loan apps is to get money quickly. The best quick loan apps in the UAE offer fast approval and send funds without long waiting times.

Apps that use smart digital systems can review applications almost instantly. In many cases, the approved amount is transferred to the user’s bank account within minutes or a few hours, making these platforms ideal for urgent financial needs.

4. Safety and Regulatory Compliance

Security is a key factor when choosing a loan app. Users should make sure the platform follows UAE Central Bank rules and operates legally within the country.

The best instant cash loan apps in the UAE use strong security measures, such as data encryption and secure payment systems. This helps protect personal and financial information and ensures safe, reliable transactions for borrowers.

5. Ease of Use and Customer Support

A good loan app should be simple to use and easy to understand. Clear menus, smooth navigation, and a clean design help users complete the loan process without confusion.

Trusted personal loan apps in the UAE also offer helpful customer support. Many provide assistance in multiple languages, making it easier for Dubai’s diverse population to get answers and resolve issues quickly.

6. Trustworthiness and Reviews

A loan app’s reputation matters a lot. Before choosing one, it’s smart to check ratings and reviews on app stores or trusted fintech websites. Positive feedback from other users usually shows that the app is reliable, transparent, and delivers what it promises.

By looking at these factors loan options, costs, speed, security, usability, and reputation borrowers in the UAE can pick instant loan apps that are not only fast but also safe and dependable.

One app for both iOS and Android means more users and higher earnings.Grow Your Business and Audience!

Top 25 Instant Loan Apps in the UAE: In-Depth Reviews

1. Beehive

Beehive is one of the UAE’s leading peer-to-peer lending platforms, connecting businesses that need funding with investors who can provide it. Unlike traditional banks, Beehive makes it easy for small businesses and startups to get loans quickly through a fully digital platform, making it one of the top instant loan apps in the UAE for business owners.

Key Features

- Offers loans specifically for SMEs at competitive rates.

- Peer-to-peer model helps businesses access funds faster.

- Simple digital application with minimal paperwork.

- Flexible repayment options suited to business growth.

Why It Stands Out

Beehive focuses on supporting startups and small businesses, a segment often overlooked by banks. Using technology for credit evaluation and document checks, it ensures quicker loan approvals. While it’s more suited for business financing than personal loans, it remains one of the best online loan apps in the UAE for entrepreneurs.

Pros and Cons

| Pros | Cons |

| Quick loan disbursement for businesses | Not designed for salaried individuals seeking personal loans |

| Transparent fees and interest rates | Loan approval depends on business performance |

| Supports startups and SMEs, promoting financial inclusion | Limited to business-related loans |

For entrepreneurs in Dubai, Abu Dhabi, or across the Emirates, Beehive is a reliable option for fast and convenient business financing.

2. FlexxPay

FlexxPay is a financial wellness app that lets employees access a part of their earned salary before payday. This approach helps reduce money stress and avoids the need for high-interest payday loans, making it one of the most practical instant cash loan apps in the UAE.

Key Features

- Gives salary advances instantly without waiting for the regular payday.

- Easy-to-use mobile app for quick access to funds.

- Works with employers to ensure safe and secure transactions.

- Promotes financial wellbeing by helping users avoid expensive debt cycles.

Why It Stands Out

FlexxPay focuses on employees rather than traditional borrowing. Instead of taking a loan with interest, users can access their own earned money early. This makes it a safer, smarter alternative to other quick loan apps. For expatriates and salaried workers in Dubai who face mid-month cash shortages, FlexxPay is one of the best instant loan apps in the UAE for handling urgent expenses responsibly.

Pros and Cons

| Pros | Cons |

| No interest or hidden fees | Only works if your employer partners with FlexxPay |

| Reduces dependence on traditional loans | Limited to a portion of your salary, not full loan amounts |

| Fast, simple, and convenient |

FlexxPay is ideal for employees who want financial flexibility between paychecks without taking on extra debt.

3. MoneyMall

MoneyMall is a popular online loan app in the UAE that lets users explore and compare multiple loan options in one place. Unlike apps tied to a single lender, MoneyMall acts as a loan marketplace, connecting borrowers with several banks and financial institutions through a simple digital platform.

Key Features

- Brings together loan offers from multiple banks in the UAE.

- Lets users compare interest rates, fees, and repayment plans.

- Offers both personal and business loan options.

- Quick online application and approval process.

Why It Stands Out

MoneyMall’s main advantage is giving users the power to choose the best deal without visiting different banks. It helps borrowers find affordable loans that match their needs. For those looking for instant loan apps in the UAE that focus on both speed and cost-effectiveness, MoneyMall is a strong choice.

Pros and Cons

| Pros | Cons |

| Compare multiple loan options in one platform | Approval times depend on the selected bank |

| Clear and transparent fee and interest comparisons | Some loans may have strict eligibility requirements |

| Offers a variety of loan types for personal and business use |

For residents in Dubai or across the Emirates looking for the most competitive rates, MoneyMall is one of the top online loan apps to find the right loan quickly and conveniently.

Build a safe and easy-to-use loan app with quick approvals and smooth payments. Make your vision come to life today!Want to Develop Your Own Instant Loan App?

4. Emirates NBD

Emirates NBD, one of the UAE’s largest and most trusted banks, offers a mobile app that lets eligible customers access personal loans quickly. By combining the reliability of a traditional bank with the convenience of digital lending, it is a top choice for those who want both speed and security.

Key Features

- Apply for instant personal loans through the mobile app.

- Flexible repayment options ranging from a few months to several years.

- Competitive interest rates compared to some fintech apps.

- Easy integration with existing Emirates NBD accounts.

Why It Stands Out

Emirates NBD’s main advantage is trust. As a well-established bank, it follows strict regulatory standards, giving borrowers peace of mind. Existing customers benefit from faster approvals because the bank already has their financial information.

Pros and Cons

| Pros | Cons |

| Backed by a leading UAE bank | Mostly available to existing account holders |

| Clear terms and transparent repayment plans | May require a minimum salary for eligibility |

| Quick approvals for account holders |

For residents in Dubai and across the Emirates who want a mix of speed, reliability, and security, Emirates NBD is one of the best personal loan apps in the UAE.

5. CashNow

CashNow is a popular instant cash loan app in the UAE, designed to provide quick financial help in emergencies. It’s ideal for individuals who need small to medium loan amounts fast. The app is simple to use, and applications are usually approved within minutes.

Key Features

- Quick approval for small and medium loans.

- Funds are sent directly to your bank account.

- Easy online application with minimal paperwork.

- Transparent repayment terms with reminders to help you stay on track.

Why It Stands Out

CashNow is known for speed. Whether you need money for medical bills, car repairs, or sudden travel, it delivers funds quickly. It’s especially helpful for salaried workers who might run short on cash before payday, making it one of the most reliable quick loan apps in the UAE.

Pros and Cons

| Pros | Cons |

| Very fast approval and fund transfer | Higher interest rates than traditional banks |

| User-friendly mobile app | Only suitable for short-term loans |

| Clear repayment schedules with alerts |

For Dubai residents looking for a fast, easy, and stress-free loan solution, CashNow is among the top instant loan apps for emergencies.

6. Prime Loans

Prime Loans is a well-known instant loan app in the UAE, offering flexible loan options for both UAE nationals and expatriates. It provides a quick and easy way to access funds without going through the lengthy procedures of traditional banks.

Key Features

- Loan amounts suitable for personal expenses or small business needs.

- Competitive repayment plans.

- Apply anytime via the mobile app, 24/7.

- Multilingual support to assist Dubai’s diverse expatriate community.

Why It Stands Out

Prime Loans focuses on accessibility, making it perfect for people with limited credit history. Its simple approval process ensures faster access to money compared to conventional banks, making it one of the top instant loan apps in the UAE for newcomers and expats.

Pros and Cons

| Pros | Cons |

| Available to both UAE nationals and expats | Larger loans may have stricter eligibility requirements |

| Flexible loan amounts and repayment options | Processing fees can vary |

| Good customer support with multilingual service |

For anyone in the UAE looking for a personal loan app that combines speed, flexibility, and inclusivity, Prime Loans is a reliable choice.

7. Jawab Loans

Jawab Loans is quickly becoming a trusted instant loan app in the UAE, offering simple and fast lending solutions for individuals who need immediate financial support. It removes the usual hassles of traditional loans, giving users quick and clear access to funds.

Key Features

- Fast loan approval through a mobile-first platform.

- Flexible repayment plans to suit different needs.

- Supports small personal loans for emergencies or everyday expenses.

- Digital KYC and easy verification process.

Why It Stands Out

Jawab Loans focuses on convenience and speed. It reduces paperwork and approval time compared to traditional banks, making it popular among young professionals and expats. Its transparent loan terms ensure borrowers know exactly what to expect before taking the loan.

Pros and Cons

| Pros | Cons |

| Simple application with minimal documents | Interest rates can be higher than banks |

| Quick approval and direct transfer of funds | Loan amounts are usually small to medium |

| Transparent repayment terms and fees |

For Dubai residents looking for a fast and hassle-free digital loan, Jawab Loans is one of the top choices for quick personal financing.

As a top mobile app development company in UAE, The Hashtech creates secure, high-performance apps similar to UPX. With years of experience in Dubai’s app development industry, The Hashtech specializes in building apps that meet and exceed user expectations. Using the latest technologies, they deliver reliable, high-quality applications designed for smooth and efficient performance.

A trusted solution for short-term loans with easy and convenient repayment options.

8. FinBin

FinBin is a modern online loan app in the UAE that uses technology to make borrowing faster and simpler. It’s designed for people who need short-term loans quickly, without the lengthy processes of traditional banks.

Key Features

- Uses AI-based credit scoring for faster approvals.

- Offers small to medium personal loans.

- Clear interest rates and repayment options.

- Easy-to-use mobile app with multilingual support.

Why It Stands Out

FinBin stands out because of its smart technology, which speeds up credit checks and allows personalized loan offers. It’s ideal for individuals needing emergency cash quickly, making it one of the most efficient instant cash loan apps in the UAE.

Pros and Cons

| Pros | Cons |

| Fast approval using AI technology | Loan amounts may be smaller than traditional banks |

| Transparent terms with no hidden fees | Higher interest rates for users with limited credit history |

| Available for both UAE nationals and expats |

For anyone in the UAE seeking a tech-driven and transparent personal loan app, FinBin is a reliable and convenient choice.

9. NowMoney

NowMoney is a socially-focused instant loan app in the UAE, designed to support low-income workers and expatriates who may not have access to traditional banking services. Its goal is financial inclusion, making it a valuable solution for residents across Dubai and other Emirates.

Key Features

- Provides financial services for low-wage workers.

- Digital wallet with salary access and money transfer options.

- Micro-loans for urgent or emergency needs.

- Simple mobile app with support for multiple languages.

Why It Stands Out

Unlike most loan apps in the UAE that mainly serve salaried professionals, NowMoney focuses on underserved communities. By offering affordable micro-loans, it helps workers manage emergencies without resorting to high-interest lenders. This makes it one of the best instant loan apps in the UAE for migrant workers seeking fast and fair financial solutions.

Pros and Cons

| Pros | Cons |

| Supports financial inclusion for low-income workers | Loan amounts are usually small |

| Multilingual app for diverse communities | Access may depend on employer participation |

| Quick loans with minimal paperwork |

For Dubai’s expatriate workforce and low-income earners, NowMoney provides a practical, responsible, and fast way to access funds when needed.

10. Liv Bank

Liv Bank, a digital-only bank launched by Emirates NBD, is one of the UAE’s leading choices for young professionals and millennials. It offers a modern banking experience along with instant personal loans, making it one of the top online loan apps in the UAE.

Key Features

- Fully digital banking for savings, payments, and loans.

- Instant loan approval through the Liv mobile app.

- Flexible repayment options with competitive interest rates.

- Lifestyle and gamified features designed for younger users.

Why It Stands Out

Liv Bank is ideal for tech-savvy users who value speed and convenience. By combining financial services with lifestyle perks, it makes borrowing simple and user-friendly. Backed by Emirates NBD, it offers the reliability of a traditional bank while staying innovative and digital-first.

Pros and Cons

| Pros | Cons |

| Fully digital banking experience | Some features may be limited to existing Liv Bank users |

| Fast and easy personal loan approvals | Eligibility depends on income and residency |

| Backed by a trusted UAE financial institution |

For young professionals and experts in Dubai, Liv Bank is a versatile instant loan app that blends modern digital banking with quick, reliable loan services.

We offer complete loan app development that’s secure, scalable, and customized for your business.Searching for a Reliable Partner to Create Your Loan App?

11. Tarabut

Tarabut is a modern instant loan app in the UAE, focused on connecting users with multiple banks and fintech providers through a single platform. It has built partnerships with over 30 banks, 50+ fintech companies, and gives access to millions of accounts. The app provides personalized support and guidance, helping both individuals and businesses find the right loan quickly. With its digital-first approach, users can apply for fast loans without the usual paperwork.

Feature Highlights

- Combines multiple banks and fintech providers on one open banking platform.

- Lets users compare and apply for loans from different institutions easily.

- Uses secure API-based connections to speed up approvals and share data safely.

- Caters to both personal borrowers and SMEs with flexible loan options.

Why Does It Stand Out?

Tarabut stands out as a fintech innovator in the UAE lending space. By using open banking technology, it gives users full control of their financial data and delivers personalized loan offers. Borrowers can manage their financial profiles, compare multiple options, and get faster approvals all from one app.

Pros and Cons

| Pros | Cons |

| Smart data sharing allows fairer, more suitable loan offers | Loan availability depends on partnered institutions |

| Compare multiple banks and fintechs in one platform | Open banking may be confusing for some users |

| Fast, fully digital loan process |

Tarabut is ideal for tech-savvy individuals and businesses looking for a modern, transparent, and efficient way to explore loan options in the UAE. It’s especially useful for SMEs seeking quick access to real-time financial solutions.

12. CashU

CashU is a popular loan app in the UAE, known for providing fast and convenient access to personal loans. The app is designed to make borrowing simple, allowing users to get funds in their accounts sometimes within the same day. With an easy-to-use interface and minimal paperwork, CashU has become a reliable option for residents in Dubai and across the Emirates who need quick financial support.

Feature Highlights

- Offers instant access to microloans, digital payments, and wallet top-ups.

- Quick personal loans with flexible repayment plans and minimal documentation.

- Short-term financial assistance delivered efficiently, helping users get funds in hours.

Why Does It Stand Out?

CashU focuses on speed and simplicity. Originally a platform for digital payments and prepaid services, it has evolved into a tool for instant microloans. Its digital-first approach makes it ideal for anyone who needs fast cash without visiting a bank or dealing with complicated procedures.

Pros and Cons

| Pros | Cons |

| Paperless and fast loan application | Loan amounts are smaller than traditional banks |

| Ideal for short-term financial needs | Interest rates and eligibility depend on user profile |

| Easy connection with digital wallets and payment services |

CashU is one of the UAE’s most accessible loan apps, providing quick, digital, and hassle-free financial solutions. It’s perfect for anyone needing urgent funds and prefers a fully online process.

Curious about the cost of developing an app in Dubai? Read our latest blog for a simple breakdown of expenses and what to expect.

13. LendMe

LendMe is a user-friendly loan app in the UAE designed to meet a variety of financial needs quickly. Since 2019, it has helped individuals and small businesses access loans with minimal paperwork and a smooth online process. The platform continues to improve its services to make borrowing fast, simple, and transparent.

Feature Highlights

- Connects users to multiple lenders in the UAE on a single digital platform.

- Allows instant comparison of loan types, interest rates, and repayment plans.

- Offers loans for personal use, cars, and small businesses.

- Simple online application with fast sign-up and minimal documentation.

Why Does It Stand Out?

LendMe simplifies the borrowing process by bridging the gap between borrowers and lenders. It provides clear, side-by-side comparisons of loan options tailored to the user’s financial profile. The focus on speed, simplicity, and transparency helps borrowers pick the best loan without visiting multiple banks or financial institutions.

Pros and Cons

| Pros | Cons |

| Quick and hassle-free loan applications | Approval time can vary depending on the lender |

| Clear comparison of interest rates and repayment plans | Some loan packages require extra documents or eligibility checks |

| Wide network of lenders with diverse loan options |

LendMe is perfect for UAE residents who want a fast, all-in-one platform to compare and apply for loans. It’s especially useful for anyone looking for instant approval, easy disbursal, and transparent borrowing options.

14. PayBy

PayBy is a user-friendly and convenient fintech app in the UAE that combines digital payments with instant loan options. It eliminates the need to visit a bank by offering a fully digital process for loan applications, approvals, and disbursements. With strong security features and partnerships with major UAE banks, PayBy ensures a safe and transparent borrowing experience for its users.

Feature Highlights

- Provides quick personal loans alongside digital payments and transfers through an easy-to-use mobile app.

- Integrates multiple banking services in one platform, allowing users to manage finances, request loans, and complete transactions instantly.

- Supports secure biometric authentication, fast KYC checks, and online loan applications for both salaried and self-employed individuals.

Why It Stands Out?

PayBy is ideal for users who want speed, simplicity, and security. By combining payment convenience with immediate loan access, it removes the need for traditional banking steps. Its fully digital process makes it perfect for those who prefer fast, hassle-free financial solutions.

Pros and Cons

| Pros | Cons |

| Quick, paperless loan application | Loan options depend on partnered financial institutions |

| Combines loans, payments, and financial management in one app | Offers may vary based on user profile and credit score |

| Simple interface with instant eligibility checks | Some features may be limited to certain users |

PayBy is one of the UAE’s most efficient digital loan apps, suitable for anyone who needs instant access to funds while enjoying a secure, easy-to-use platform.

Perfect for users who value convenience, speed, and reliability.

15. FAB Mobile

FAB Mobile is a widely trusted banking and loan app in the UAE, offered by First Abu Dhabi Bank, one of the region’s largest and most respected financial institutions. It combines digital banking and instant loan services in a single, easy-to-use platform, allowing users to manage their finances, access personal loans, and handle everyday banking tasks without visiting a branch. With fast approvals for eligible customers and flexible repayment plans, FAB Mobile is a convenient solution for modern financial needs.

Feature Highlights

- Provides instant personal loans for eligible FAB customers directly through the app.

- Offers full digital banking services, including fund transfers, bill payments, credit card management, and account monitoring.

- Transparent loan terms and flexible repayment options, helping users borrow confidently with no hidden charges.

Why Does It Stand Out?

FAB Mobile combines the reliability of a major UAE bank with modern digital banking convenience. Its secure, regulated platform ensures compliance with UAE banking rules while providing fast personal loan approvals. The app’s all-in-one approach offering loans alongside everyday banking tools makes it a top choice for residents seeking quick, secure, and reliable financial solutions.

Pros and Cons

| Pros | Cons |

| Instant loan approvals for eligible salary-transferred customers | Only available to existing FAB account holders |

| Full digital banking services in a single app | Loan eligibility depends on salary transfer and profile |

| High security, regulated, and transparent loan terms |

FAB Mobile is one of the UAE’s most dependable digital banking and loan apps, delivering quick access to funds, safe online transactions, and a smooth digital experience. Perfect for users who value speed, security, and trusted banking services.

Smart solutions designed to grow with your business.Build a Safe and Scalable Fintech App

16. E & Money

E & Money is a fast and easy-to-use loan app in the UAE, designed for people who need quick cash without complicated steps. The app allows users to apply for loans instantly and receive funds in a safe and efficient way. Whether it’s for personal emergencies or urgent expenses, E & Money makes borrowing simple and reliable.

The app is fully digital, 24/7, and supports multiple languages, making it accessible to both UAE nationals and expatriates. Its focus is on speed, transparency, and convenience, helping users get money when they need it most.

Feature Highlights

- Fast loan approvals with minimal documentation.

- Flexible repayment options based on income and loan type.

- Transparent interest rates and loan terms.

- 24/7 application via a multilingual mobile app.

Why It Stands Out?

E & Money is known for its speed, accessibility, and transparency. The app uses smart verification technology to ensure loans are processed safely and quickly. With strong customer support and clear terms, it has become one of the most trusted instant loan apps in the UAE for short-term financial needs.

Pros and Cons

| Pros | Cons |

| Quick and safe loan disbursement | Loan amounts may be limited for first-time users |

| Low eligibility requirements | Interest rates may vary depending on credit profile |

| Accessible to both UAE nationals and expats | |

| No hidden fees or complicated procedures |

E & Money is perfect for anyone in the UAE looking for fast, transparent, and reliable financial support. It bridges the gap between urgent cash needs and easy digital access, making borrowing stress-free and secure.

Loans are paid back in equal monthly amounts until the balance is cleared. If you need quick cash, apps like MoneyLion can be a good option.

17. Flex

Flex is a growing personal loan app in the UAE that makes borrowing fast and simple. Users can apply for loans up to AED 10,000, with quick approvals and easy access to funds. The app lets users explore different loan options and choose the one that best fits their needs and budget.

Feature Highlights

- Fast loan approval and quick fund transfer.

- Flexible loan amounts and repayment plans.

- Transparent interest rates and fees with no hidden charges.

- Easy-to-use mobile app available in multiple languages.

- Secure digital verification for safe transactions.

Why It Stands Out?

Flex stands out for offering a personalized borrowing experience. Unlike many traditional loan apps, it allows users to adjust repayment schedules based on their income and preferences. Its flexibility and fast digital process make it one of the most convenient personal loan apps for both UAE nationals and expatriates.

Pros and Cons

| Pros | Cons |

| Quick online application and instant approval | Loan amounts may be limited based on credit checks |

| Flexible repayment plans to suit income levels | Smaller or short-term loans may have higher interest rates |

| Transparent and customer-friendly service | |

| Available for both UAE nationals and expats |

Flex is ideal for anyone in the UAE looking for fast, flexible, and transparent personal loans, giving borrowers control over how and when they repay.

18. Lindo

Lindo is becoming a popular loan app in the UAE, especially for individuals and small businesses who need fast cash. Approved by the UAE Financial Service Regulatory Authority, Lindo offers short-term, unsecured loans with minimal paperwork. Whether you need funds for personal expenses or small business capital, Lindo provides a simple and quick solution.

Loans are often approved and disbursed within a week, making it ideal for urgent financial needs. The process is fully digital, so users don’t have to worry about visiting a bank or submitting extensive documentation.

Feature Highlights

- Fast online loan platform, ideal for SMEs and startups.

- AI-based credit scoring for accurate and fair loan evaluation.

- Flexible loan amounts and repayment options.

- Integrates smoothly with online banking and e-commerce systems.

- Completely digital and paperless application process.

Why It Stands Out?

Lindo is designed to help small businesses and startups access funds quickly without traditional banking hurdles. Its AI-driven credit assessment allows fast approvals with minimal documentation. By combining transparency, speed, and flexibility, Lindo makes borrowing simple and reliable, giving entrepreneurs more time to focus on growing their business.

Pros and Cons

| Pros | Cons |

| Tailored for SMEs and startups | Not suitable for large loans for big businesses |

| Fast approvals with minimal documentation | Requires digital banking and business data access |

| Flexible interest rates and repayment options | |

| Supports business growth and cash flow management |

Lindo is ideal for UAE entrepreneurs and individuals who want quick, transparent, and hassle-free loans. It blends technology with reliability, allowing users to focus on their work instead of financial stress.

19. Mashreq UAE

Mashreq UAE is a popular instant loan app that allows users to get quick personal or business loans across the country. The app is designed to provide fast approvals, simple digital processes, and rewards for loyal customers, making it a convenient choice for residents who need quick cash.

With Mashreq UAE, borrowers can manage their loans entirely online, whether through the app or web, while enjoying flexible repayment plans and competitive interest rates.

Feature Highlights

- Offers personal and business loans with clear repayment terms and fast processing.

- Simple digital interface with quick eligibility checks.

- Supports salary-transfer and non-salary-transfer loans, balance transfers, and attractive top-up offers for existing customers.

Why It Stands Out?

Mashreq UAE combines innovation with reliability. Being one of the oldest and most technologically advanced banks in the country, it ensures secure and fast loan disbursal with minimal paperwork. Its Mashreq Neo platform allows borrowers to manage their loans, make repayments, and monitor finances directly from their mobile phones or computer, anytime and anywhere.

Pros and Cons

| Pros | Cons |

| Fast and easy loan application and approval | Some loan products require salary transfer to a Mashreq account |

| Wide range of personal and business loan options | Approval time may vary based on employment or credit profile |

| Reputable bank with advanced digital services | |

| Digital loan management via Mashreq Neo |

Mashreq UAE is ideal for borrowers who want a blend of trusted banking and digital convenience. It offers competitive, transparent loans with quick access to funds, making it perfect for salary-account holders or business owners seeking fast financial support.

20. ADCB Hayyak

ADCB Hayyak is a fast and convenient loan app in the UAE that lets users get personal or business loans instantly. With this app, you can apply for a loan, check eligibility, and manage your account all from your phone, without visiting a bank branch.

The app also comes with a loan calculator, helping you pick the loan amount and repayment plan that best fits your needs. Once approved, the funds are quickly transferred to your account, giving you easy access to cash whenever required.

Feature Highlights

- Instant loan application and account setup directly through the mobile app.

- 100% digital process no branch visits required.

- Offers personal and business loans with competitive interest rates, flexible repayment schedules, and minimal paperwork.

Why It Stands Out?

ADCB Hayyak is known for its speed and simplicity. The app provides digital onboarding in minutes, making account opening and loan approval quick and easy. Backed by the credibility of ADCB, it combines secure banking with a paperless experience, making it a top choice for UAE residents who value efficiency and transparency.

Pros and Cons

| Pros | Cons |

| Fully online loan application and account setup | Some loans limited to ADCB account holders |

| Fast approvals with minimal paperwork | Eligibility depends on income and employment type |

| Secure, user-friendly mobile experience | |

| Flexible repayment plans |

ADCB Hayyak is perfect for anyone in the UAE who wants quick, reliable, and digital-first loans. It provides fast access to funds while maintaining the trust and security of a major bank, making it ideal for modern borrowers who prioritize convenience and safety.

Related read: Want to cash checks fast without using Ingo Money? Check out our article covering top mobile apps that let you do it right from your phone.

21. RakBank

RakBank is a fast and reliable loan app in the UAE that helps you get urgent cash when needed. Users can borrow up to AED 150,000 with minimal paperwork, making it a top choice for both salaried employees and self-employed individuals.

The app is designed for simplicity no complicated wage transfers are required. Loans are disbursed quickly, and repayments can be managed through Direct Debit from your salary account. With flexible repayment options of up to 48 months and competitive interest rates, borrowing has never been easier. Plus, 24/7 phone banking ensures support whenever you need it.

Feature Highlights

- Offers personal loans, business loans, and SME financing.

- Competitive interest rates and flexible repayment plans.

- Quick online eligibility checks and clear loan structures.

- Minimal documentation and a fully digital process.

Why It Stands Out?

RakBank stands out for its speed, flexibility, and customer-focused approach. Unlike many lenders, it caters to both employed and self-employed borrowers. Quick disbursal and simple application procedures make it ideal for urgent financial needs, giving users instant access to funds without unnecessary delays.

Pros and Cons

| Pros | Cons |

| Fast loan approval and disbursal | Interest rates may vary based on salary and employer |

| Minimal documentation required | Early repayment fees may apply |

| Competitive interest rates | |

| Available to both salaried and self-employed users |

RakBank is perfect for UAE residents who need quick, transparent, and flexible loans. Its fast processing, simple digital interface, and reliable support make it one of the most trusted options for personal and business finance in the UAE.

22. ADIB Mobile

ADIB Mobile, from Abu Dhabi Islamic Bank (ADIB), is one of the UAE’s top Shariah-compliant banking and loan apps. It gives users a secure and smooth digital banking experience, with instant access to personal finance solutions that follow Islamic principles. The app lets you apply for finance, manage accounts, transfer money, and handle daily banking tasks—all from your phone. Its trusted reputation and easy-to-use interface make it a popular choice for customers looking for quick, reliable, and ethical financial services.

Feature Highlights

- Offers Shariah-compliant instant personal finance for eligible users.

- Lets you manage accounts, cards, bill payments, and transfers in real time.

- Flexible repayment plans, minimal paperwork, and clear profit rates instead of traditional interest.

Why It Stands Out?

ADIB Mobile stands out for combining modern digital banking with Shariah-compliant finance. It ensures all transactions follow Islamic principles while giving fast access to funds. The platform is secure, transparent, and simple to use, making it ideal for those who want quick financing without compromising ethical guidelines.

Pros and Cons

| Pros | Cons |

| Fully Shariah-compliant personal finance options | Loan approval depends on eligibility and salary transfer |

| Fast approvals for eligible customers | Non-ADIB customers may have limited access |

| Secure and easy-to-use digital banking |

ADIB Mobile is perfect for UAE residents who want fast, safe, and Shariah-compliant finance. Its combination of ethical finance, digital convenience, and reliable service makes it a top choice for individuals seeking trustworthy instant loans and banking solutions.

Create mobile apps that make banking, lending, and payments easy while keeping users secure and compliant.Trusted, Safe, and Scalable FinTech App Development by The Hashtech!

23. Al Hilal Bank

Al Hilal Bank Mobile App is a modern, fully Shariah-compliant banking platform in the UAE, designed for fast, secure, and convenient financial services. The app offers an easy way to access instant Islamic personal finance, manage accounts, track spending, and make payments all from your phone. With clear profit rates and smooth processing, it’s a top choice for residents who want reliable and ethical digital banking.

Feature Highlights

- Provides Shariah-compliant instant personal finance for eligible users.

- Offers full digital banking services, including transfers, bill payments, card management, and budgeting tools.

- Simple navigation, minimal documentation, and smart financial insights for a smooth user experience.

Why It Stands Out?

Al Hilal Bank Mobile is unique because it combines Islamic banking principles with modern digital innovation. The app focuses on speed, transparency, and security while ensuring all finance solutions follow Shariah rules. Its real-time processing and easy-to-use interface make it ideal for users who want fast financial support without compromising their ethical values.

Pros and Cons

| Pros | Cons |

| 100% Shariah-compliant personal finance options | Eligibility and salary transfer affect instant finance availability |

| Fast approvals with minimal paperwork | Limited features for non-Al Hilal account holders |

| Modern and smooth interface with secure transactions |

Al Hilal Bank Mobile is considered one of the most reliable and advanced Islamic digital banking apps in the UAE, providing fast, ethical, and fully digital finance solutions.

Perfect for users looking for safe, Shariah-compliant, and quick banking services.

24. IOU Financial

IOU Financial is a popular digital loan platform in the UAE, built to provide fast, easy, and reliable access to personal and business loans. The app simplifies the borrowing process with quick approvals and direct fund transfers, requiring very little paperwork. Its focus on speed, transparency, and convenience makes it a top choice for residents and small businesses looking for short-term financial support.

Feature Highlights

- Offers instant personal and business loans with quick approvals.

- Fully digital application and loan management, including tracking and repayment schedules.

- Flexible repayment plans, clear terms, and fast disbursement directly to users’ accounts.

Why It Stands Out?

IOU Financial is different because it emphasizes speed, simplicity, and a paperless experience. Unlike traditional banks, users can apply, get approved, and receive funds quickly, all from their mobile device. The app also provides transparent eligibility rules and flexible repayment options, making it convenient for anyone who needs money quickly.

Pros and Cons

| Pros | Cons |

| Fast and paperless loan application | Loan amounts may be smaller than traditional banks |

| Quick access to funds for urgent needs | Eligibility and repayment depend on user profile and financial history |

| Fully digital platform with easy loan tracking |

IOU Financial is one of the most convenient digital loan apps in the UAE, offering a fast, secure, and fully online borrowing experience.

Ideal for users who want hassle-free, instant loans with full digital convenience.

Related read: Looking for ways to get money before payday? See our post on the top apps similar to Earnin that can help.

25. Credy

Credy is a popular digital loan platform in the UAE, built to provide fast, easy, and trustworthy access to personal loans. The app simplifies borrowing with a quick approval process and direct fund transfers, requiring minimal paperwork. Its focus on convenience, speed, and transparency makes it a top choice for UAE residents who need immediate financial support.

Feature Highlights

- Provides instant personal loans with quick approval for eligible users.

- Fully digital platform for applying, managing loans, and tracking repayments.

- Flexible repayment options with clear, transparent terms.

Why It Stands Out?

Credy stands out because it is fully digital and paperless, giving users fast access to money without visiting a bank. Its intuitive interface and easy repayment plans make borrowing stress-free. Fast disbursement and clear terms ensure that residents can meet urgent financial needs quickly and safely.

Pros and Cons

| Pros | Cons |

| Fast, paperless loan application | Loan amounts may be smaller than traditional banks |

| Quick access to funds for short-term needs | Approval depends on user profile and credit history |

| Fully digital platform with easy loan tracking |

Credy is a convenient choice for those looking for speedy, simple, and secure personal loans in the UAE.

Ideal for users who want quick cash with minimal hassle and a fully digital experience.

Quick Comparison of Top Instant Loan Apps in UAE

Here’s a side-by-side look at the best instant loan apps in the UAE, showing loan ranges, approval speed, repayment options, and key features. This makes it easier to pick the app that fits your needs.

| App Name | Loan Amount Range | Approval Time | Repayment Terms | Notable Features |

| Beehive | AED 50,000 – AED 500,000 (business) | 24–48 hours | Flexible SME terms | Peer-to-peer lending for SMEs |

| FlexxPay | Portion of earned salary | Instant | Until payday | Salary advance model |

| MoneyMall | Varies by bank/offer | Few hours – 2 days | Flexible per bank | Loan marketplace, compare rates |

| Emirates NBD | AED 5,000 – AED 200,000 | Instant for customers | 6–48 months | Backed by a trusted bank |

| CashNow | AED 1,000 – AED 20,000 | Within minutes | Short-term | Emergency cash loans |

| Prime Loans | AED 5,000 – AED 100,000 | Few hours | 6–24 months | Expats & nationals, multilingual |

| Jawab Loans | AED 1,000 – AED 15,000 | Instant | Short-term | Transparent, app-first process |

| FinBin | AED 1,500 – AED 25,000 | Minutes – few hours | Flexible | AI-driven credit scoring |

| NowMoney | AED 500 – AED 5,000 | Same day | Short-term | Financial inclusion for workers |

| Liv Bank | AED 5,000 – AED 100,000 | Instant | 6–36 months | Digital bank with lifestyle perks |

| Tarabut | AED 1,000 – AED 50,000 | Few hours | Flexible | Open banking, compare multiple lenders |

| CashU | AED 500 – AED 30,000 | Same day | Short-term | Quick microloans, simple digital process |

| LendMe | AED 1,000 – AED 50,000 | Instant | 6–36 months | Easy comparison, multiple lenders |

| PayBy | AED 1,000 – AED 50,000 | Instant | Flexible | Digital payments + instant loans |

| FAB Mobile | AED 5,000 – AED 5,000,000 | 1–3 days | 6–48 months | Backed by bank, digital loan management |

| E & Money | AED 1,000 – AED 15,000 | Instant | Short-term | Quick, 24/7 loan app |

| Flex | AED 1,000 – AED 10,000 | Instant | Flexible | Personalized lending, easy digital process |

| Lindo | AED 1,500 – AED 50,000 | Within a week | Flexible | SME-friendly, AI credit scoring |

| Mashreq UAE | AED 5,000 – AED 200,000 | Few hours – 1 day | 6–48 months | Salary & non-salary accounts, loyalty rewards |

| ADCB Hayyak | AED 5,000 – AED 150,000 | Instant | 6–48 months | Digital onboarding, quick approvals |

| RakBank | AED 5,000 – AED 150,000 | Instant – 1 day | 6–48 months | Direct debit repayment, fast disbursal |

| ADIB Mobile | AED 5,000 – AED 200,000 | Instant for eligible customers | 6–48 months | Shariah-compliant, secure digital banking |

| Al Hilal Bank | AED 5,000 – AED 200,000 | Instant for eligible customers | 6–48 months | Shariah-compliant, digital-first platform |

| IOU Financial | AED 5,000 – AED 5,000,000 | Few hours – 1 day | Flexible | Instant business & personal loans |

| Credy | AED 1,000 – AED 50,000 | Instant | 6–36 months | Quick, paperless, fully digital |

Develop a custom banking app with instant transactions, easy account control, and smooth user experience.Create a Scalable Mobile Banking App for Your FinTech Company!

How to Choose the Right Loan App

If you need fast cash for emergencies, apps like CashNow, Jawab Loans, or FinBin are the quickest options.

For bigger personal loans from well-known banks, Emirates NBD and Liv Bank are reliable and secure choices.

Business owners or entrepreneurs can consider Beehive for SME loans, while MoneyMall is great for comparing multiple loan options at once.

For workers looking for inclusive financial solutions, NowMoney is practical, and FlexxPay is perfect for getting early access to your salary.

The key takeaway is that there isn’t a single “best” app for everyone. Your choice depends on your needs, whether it’s loan size, repayment flexibility, or the speed of getting funds. Whether you’re in Dubai or anywhere in the UAE, the best loan app is the one that fits your financial goals and personal situation.

How to Create an Instant Loan App in the UAE

The rise of instant loan apps in the UAE, such as CashNow, FlexxPay, and Liv Bank, shows that digital lending is becoming a key part of modern finance. For startups, fintech companies, and banks, this is a great chance to develop apps that offer fast, safe, and transparent loan services.

If you want to know how to build an app like CashNow or launch your own digital lending platform, follow this step-by-step guide:

1. Study the Market and Legal Rules

Before building an instant loan app in the UAE, it’s important to understand the local fintech market and the legal rules. The UAE has strict financial regulations, so make sure your app follows the Central Bank of UAE guidelines, including licensing, digital KYC, and anti-money laundering (AML) rules.

Look at existing apps like Emirates NBD Digital Loans or NowMoney to see how they work. Studying competitors will help you find opportunities and decide how your app can offer something unique.

2. Decide on the Key Features

Top instant loan apps in the UAE include a set of essential features:

- Quick loan application and instant approval

- Digital KYC verification to confirm user identity

- Loan calculators and repayment plans to help users plan

- Secure payment and fund transfer options

- Real-time updates and push notifications

Depending on who you’re targeting employees, expats, or small businesses you might also include salary-linked loans, multiple language support, or business loan options.

3. Work with a Professional Fintech App Developer

Creating a secure and reliable loan app is more than just writing code. Partnering with an experienced fintech app development company is key. They help make your app user-friendly, safe, and scalable, while ensuring it follows UAE financial regulations.

A skilled developer can also add AI-based credit scoring, strong data encryption, and cloud infrastructure to make the app fast, smooth, and trustworthy for users.

4. Prioritize Security and Legal Compliance

In fintech, trust is everything. Your loan app should follow UAE data protection rules, use strong encryption for all transactions, and adhere to KYC and anti-money laundering (AML) standards.

This keeps your app safe for users and aligned with regulations, building confidence and credibility in the market.

5. Build and Test Your App

Start developing your loan app step by step:

- Front-end design: Make the app easy to use on mobile with smooth navigation.

- Back-end setup: Handle loans, repayments, interest calculations, and user accounts.

- Integrations: Connect with payment gateways, banks, and credit scoring systems.

- Testing: Check every feature and transaction carefully to make sure it works correctly and securely before going live.

6. Launch and Keep Improving

Once your app is live, listen to your users and make improvements. Start with the main features, and over time, add smart tools like AI-based loan suggestions or salary-linked lending. Regular updates and improvements help your app stay useful, secure, and competitive in the UAE market.

How to Pick the Right Instant Loan App

With so many instant loan apps available in the UAE, choosing the right one can feel tricky. While most promise fast approvals and easy access to cash, the best app for you depends on your personal situation. Consider factors like how much you want to borrow, how quickly you can repay, and your credit profile. Here are some simple tips to help you choose wisely and avoid surprises.

1. Know What You Need From a Loan

Before applying, think about why you need the money. Is it for an emergency, daily expenses, or business growth? If you need cash quickly for urgent bills, fast loan apps in the UAE, such as CashNow or Jawab Loans, are a good choice. For bigger loans or longer repayment periods, personal loan apps from banks like Emirates NBD or Liv Bank work better.

2. Check Interest Rates and Charges

It’s important to know how much the loan will really cost. Different loan apps in Dubai can have very different interest rates and extra fees. Always look at the APR, any late payment fines, and processing fees before you decide.

3. Look at Repayment Options

Everyone’s finances are different. Some UAE loan apps let you repay in just a few weeks, while others give up to 36 months. Pick an app that matches your budget so you can pay comfortably without stress.

4. Make Sure the App is Safe and Legal

Your personal and financial information should always be protected. Use UAE loan apps that are regulated by the Central Bank or supported by trusted banks. Choose apps with secure logins, encryption, and clear policies.

5. Look at Reviews and Ratings

Before using any app, check what other users say. App Store, Google Play, and online forums can show how reliable an app is. The best UAE loan apps have simple approval processes and treat borrowers fairly.

6. Pick an App That Fits Your Lifestyle

Choose a loan app that matches the way you manage money. For example, FlexxPay works well if you need your salary early, Beehive is great for small business owners, and Liv Bank suits tech-savvy users looking for convenience and extra benefits.

By thinking about these points, you can pick the best instant loan app in the UAE that is fast, safe, and affordable.

Tips for Borrowing ItSmartly

Instant loan apps in the UAE are very convenient, but it’s important to use them carefully. Loans can help in emergencies, but if not managed well, they can cause financial stress. To get the most out of UAE loan apps, follow these smart borrowing tips:

1. Borrow Only What’s Necessary

It’s easy to take the maximum loan an app offers, but this can increase your interest costs. Figure out exactly how much you need and borrow only that. Loans should help you, not make things harder.

2. Know the Full Cost of the Loan

Before taking a loan, check the APR, processing fees, and any late payment charges. Many UAE loan apps have a calculator use it to see the total amount you’ll need to repay.

3. Don’t Take Multiple Loans at Once

Getting loans from several apps might feel easy, but it can quickly become hard to manage. Focus on one loan at a time and pay it off before borrowing again.

4. Pay on Time

Repaying your loan on schedule avoids extra fees and helps build a good credit record. This can make it easier to get better loan options later, especially from trusted UAE loan apps that reward responsible borrowers.

5. Maintain an Emergency Fund

Loans shouldn’t replace savings. Even if you use instant loan apps in the UAE, keep some money aside for emergencies. This helps you avoid borrowing too often and keeps your finances stable.

6. Choose Safe and Regulated Apps

Use apps supported by banks or regulated by UAE authorities. Reliable loan apps protect your data and have clear terms, so you avoid risky or unfair lending practices.

7. Plan How You’ll Repay Before Borrowing

Before applying, plan your repayment schedule. Match it with your salary dates and make sure the monthly installment fits comfortably in your budget.

By following these easy guidelines, you can use instant cash loan apps in the UAE safely. Responsible borrowing helps loans stay a useful financial tool instead of becoming a burden.

Top Finance App Development Services – The Hashtech

The Hashtech has extensive experience in building custom finance apps in Dubai. Their team of experts can develop apps for banks, fintech startups, investment firms, and other financial service providers. They create secure, scalable, and user-friendly solutions for mobile banking, personal finance, trading, or specialized accounting apps. The Hashtech stays updated with the latest financial regulations, security standards, and industry best practices to ensure compliance and reduce risks.

Important Tip

Before taking a loan from any finance app, always check the terms, interest rates, repayment schedule, and other details carefully. This helps make sure the loan fits your financial needs and prevents any surprises.

Conclusion

Loan apps in the UAE are useful for urgent expenses, last-minute bills, or even small investments. They offer clear terms and reliable support. The popularity of instant loan apps is growing as more people adopt modern technology for financial needs. Partnering with a leading app development company can help create high-quality finance apps in Dubai.

Instant loan approvals have changed how residents and expats access credit. Whether you need cash quickly or prefer flexible repayment options, there is an app to match your needs including ones designed for expats.

In the fast-changing fintech world, the best choice depends on your priorities: speed, ease of use, and minimal paperwork. Apps like Liv Bank and Beehive provide different solutions, all aimed at making online personal loans faster, simpler, and more convenient.

Build secure, user-friendly, and efficient mobile apps for banks, credit unions, and FinTech companies.Your Reliable Partner for Mobile Banking App Development!

FAQs

How to Get a Loan Using a Mobile App in the UAE

Getting a loan through a mobile app in the UAE is fast and easy. You don’t need to visit a bank or fill out long forms. Here’s a step-by-step guide:

1. Sign Up on the App

Download the loan app and create an account. Enter your basic details like name, email, and phone number to get started.

2. Complete the Loan Form

Open the app and go to the loan application section. Provide information such as:

- Your personal details

- Employment information

- Loan amount you want

- Repayment period

3. Upload Important Documents

To confirm your identity and eligibility, upload documents like:

- Emirates ID

- Passport copy

- Salary slips

- Bank statements

4. Submit Your Application

Once all details and documents are added, submit your application. Most apps process applications quickly, often within 24 hours.

5. Check Your Loan Options

If approved, the app will show you loan offers based on your income, requested amount, and repayment plan. The UAE’s mobile lending sector is growing rapidly, with a 6.5% increase in January 2025, reflecting high demand.

6. Get the Money

After selecting the loan plan, the app finalizes your request. Once approved, the funds are usually transferred to your bank account the same day. You can use the loan for personal or business purposes.

7. Repay Easily

Repay your loan according to the schedule you chose. Most apps allow flexible monthly payments to make it easier to manage.

Fun Fact:

In October 2025, the total loan value in the UAE reached $552.38 billion, showing how popular digital loans are becoming.

Which Apps Can Give Instant Loans in the UAE?

When you need money quickly, instant loan apps in the UAE are a convenient choice. They approve loans fast, require little paperwork, and let you repay in flexible ways. Here’s a list of some trusted and officially approved apps:

1. Credy

Credy gives fast personal loans with low interest rates. You don’t need to submit paperwork, and approvals usually happen within a day. You can repay over 3 to 12 months.

2. Mashreq UAE

Mashreq’s app is one of the quickest in the UAE. You can apply in just 2 minutes with your Emirates ID and a Mashreq salary account.

3. EZ Money

EZ Money makes borrowing easy. It offers fast loans with no hidden fees and repayment options that fit your budget.

4. FlexxPay

FlexxPay is made for salaried workers, especially those with smaller incomes. You can borrow up to AED 1,835 before payday to manage unexpected expenses.

5. RakBank

RakBank’s loan app is safe and easy to use. It offers different loan options for personal needs, education, or emergency funds.

6. Simplylife

Simplylife provides personal loans with simple terms and fast approvals. Supported by ADCB, it’s ideal for stress-free borrowing.

7. Pay-by

Pay-by is a fintech app that doesn’t require a credit check. Applications take only 5 minutes, making it perfect for personal, career, or lifestyle needs.

What Are the Basic Requirements for Getting a Loan in the UAE?

If you want to apply for a loan through a mobile app or a bank in the UAE, there are some basic requirements you need to meet. Different lenders may ask for slightly different documents, but most follow these common rules:

- Age: You should be between 21 and 60 years old.

- Income: A minimum monthly salary of AED 3,000 is usually required.

- Residency: You must have a valid Emirates ID proving that you live in the UAE.

- Credit History: Some credit history is preferred, even if it’s limited.

Meeting these requirements increases your chances of quick approval and a smooth loan process.

Are Instant Loan Apps in the UAE Safe?

Yes, most instant loan apps in the UAE are safe to use. They use strong security measures to protect your personal and financial information.

Still, it’s important to check the app’s security settings and make sure it follows proper data protection rules.

Before applying, carefully read the terms and conditions. Look for information about interest rates, repayment plans, and any extra fees. This will help you understand the loan clearly and avoid surprises later.

Can I Apply for Loans on Multiple Apps in the UAE?

Technically, you can apply for loans on more than one app. However, it’s not always a good idea. Applying too often can lower your credit score and make it harder to get approved in the future.

Applying on multiple apps also doesn’t guarantee approval from all of them. If one app rejects your application, it might affect your chances with other lenders. Managing several loans at the same time can also be tricky, especially when comparing interest rates, fees, and repayment plans.

The smarter approach is to research your options first, pick the loan that suits your needs best, and apply through a trusted app.

If you’re thinking about creating your own loan app, a reliable fintech app development company like The Hashtech can help you build a secure, user-friendly app to succeed in the digital lending market.