Top 25 Instant Cash Apps Like MoneyLion in 2026

9 January, 2026

The world is moving forward at a fast pace. The day-to-day rise in inflation has hit many households hard, and if you are one of those who rely heavily on your paycheck to make ends meet, this blog is for you.

We will be talking about apps that can help you get cash fast when you need it. And no, we’re not talking about payday loans, so don’t worry! Apps like MoneyLion are here to help you with everyday expenses like gas, groceries, bills, or those unexpected costs that pop up out of nowhere.

As these apps become essential for financial flexibility, the best mobile app development services are constantly pushing the boundaries of what fintech can do.

Whether you are an entrepreneur looking for emerging ideas in the Fintech industry or a user searching for better alternatives to MoneyLion, you are in the right place.

Among the hundreds of similar apps available in 2026, we have curated a list of 25+ options that will help you make smarter choices and get the cash you need, exactly when you need it most.

What You’ll Find in This Blog

- What is the MoneyLion app and how does it work?

- 15 of the best apps like MoneyLion that can help you get cash fast

- 10 other reliable MoneyLion alternatives you can trust

- What exactly are cash advance apps and how do they help you?

- Payday loan apps vs. cash advance apps: which one’s better?

- What you need to know to get a quick cash advance

- The important features to look for in a cash advance app, like MoneyLion

What is the MoneyLion App?

The MoneyLion app is a mobile app that gives you up to $250 in cash through a feature called Instacash. The best part? There are no extra fees! It’s one of the top-rated apps for cash advances right now.

This app is super helpful if you have a job with irregular hours or if you need money before your paycheck comes in. If you’re a bit low on cash and need a quick boost, MoneyLion can help you out.

To use Instacash, you’ll need to meet some basic requirements. Once you get the money, it’s automatically paid back when your next direct deposit hits.

It’s a great way to get cash quickly without paying crazy fees like with payday loans. And yes, it’s one of the many ways people are using apps to make money today.

If you’ve got a great app idea, reach out to the experts at The Hashtech and start bringing your vision to life!Have an App Idea That Could Make You a Million?

Eligibility and Costs for Apps Like MoneyLion

Apps like MoneyLion have a few basic requirements you need to meet before you can use their cash advance features. Also, these apps offer different pricing plans based on what services or features you choose.

Basic Requirements

To qualify for a cash advance from apps like MoneyLion, you generally need a checking account that meets these basic conditions:

- Your account is active and used regularly

- It’s been open for a few months

- It has a positive balance (not overdrafted)

- You get regular income deposits (like your salary or wages)

These requirements help the app make sure that you’ll be able to pay back the money once you get your next paycheck.

Cost to Use MoneyLion

- The MoneyLion Core account is free to use.

- The MoneyLion Plus account costs $19.99 per month, but you don’t need it just to get a cash advance.

- If you’re only using the Instacash feature (to get up to $250), there’s no monthly fee.

Apps like MoneyLion work like payday loan apps but usually have lower fees and more flexible ways to repay.

15 Best Apps Like MoneyLion to Try in 2025

There are plenty of apps like MoneyLion out there, but not all of them are worth your time. Some are definitely better than others.

Any top app development company can create an app for almost anything finance, healthcare, real estate, music, and more. But that’s a whole different topic.

In this post, we have put together a list of the top 15 apps like MoneyLion. Check out their features and terms, and choose the one that works best for you. These apps are also known as MoneyLion alternatives or competitors.

1. Brigit

Brigit is an app similar to MoneyLion that helps you get money between paychecks. It also monitors your bank account and sends alerts if you’re close to overdrafting or spending too much. If Brigit notices any spending issues, it will notify you immediately. You can borrow up to $250 as a cash advance, and the repayment date is based on your account activity.

If you’re looking for apps like Brigit, there are other options out there with similar features to help you manage your money and avoid overdraft fees.

Pros & Cons

| Pros | Cons |

| Alerts you before overdrafts | Max cash advance is $250 |

| Easy to use and reliable | Requires checking account |

| No interest fees on advances | Monthly subscription fee |

iOS Rating: 4.5

Android Rating: 4.8

2. Chime

Chime is one of the first and most popular alternatives to MoneyLion. It works mostly as a banking app, but it offers some features that make it stand out from regular banks.

Unlike many other cash advance apps, Chime doesn’t give you instant loans or cash advances. Instead, it offers free overdraft protection up to $200, which you can use with your Chime debit card.

Pros & Cons

| Pros | Cons |

| Free overdraft protection | No direct cash advance option |

| Easy-to-use banking features | Lower app ratings |

| No hidden fees | Limited loan options |

iOS Rating: 2.8

Android Rating: 3.1

3. Earnin

Earnin is a popular app like MoneyLion, known for having very low fees. People around the world use Earnin because of helpful features like Balance Shield Alerts and Balance Cash Outs.

The app notifies you when your bank balance falls below $400. If your balance drops under $100, you can withdraw up to $100 right away. Earnin also lets you access your earned wages early, so you don’t have to wait until payday.

Pros & Cons

| Pros | Cons |

| Low fees and no interest | Limited cash-out amount |

| Access your paycheck early | Requires regular income |

| Helpful balance alerts | Not available everywhere |

iOS Rating: 4.7

Android Rating: 4.4

4. Dave

Dave is a well-known app that became popular after appearing on Shark Tank and getting investment from Mark Cuban. It’s designed to help users avoid overdraft fees easily.

Dave calls itself a “banking app for real people” and is a trusted app like MoneyLion. It connects to your bank account and alerts you if you’re about to overdraft. You can also get a cash advance of up to $100 through the app.

If you’re looking for apps similar to Dave, there are other options that also offer overdraft alerts and small cash advances to help you manage your money.

Pros & Cons

| Pros | Cons |

| Helps avoid overdraft fees | Cash advance limit is $100 |

| Easy to use and reliable | Some features require a subscription |

| No interest on advances | Available only in the US |

iOS Rating: 4.8

Android Rating: 4.4

5. Empower

Empower is a cash advance app like MoneyLion that lets you borrow money and pay it back after your next deposit. The app doesn’t charge any interest or late fees, but it does ask for a small tip if you want to leave one.

To qualify for cash advances, you’ll need to provide proof of income and your bank details. Empower also offers free financial coaching to help you manage your money better.

Pros & Cons

| Pros | Cons |

| No interest or late fees | Android app has lower ratings |

| Free financial coaching available | Small voluntary tip requested |

| Easy to qualify with income proof | Cash advance limits apply |

iOS Rating: 4.7

Android Rating: 3.2

6. Branch

Branch is an app like MoneyLion that offers helpful features for both employees and employers. It lets workers get cash advances based on the hours they’ve worked.

Instead of offering a fixed loan amount, Branch calculates your advance by looking at how much you’ve earned. You can get up to 50% of your next paycheck early. If you need the money instantly, you can pay a small fee, which will be taken out once you get paid.

Pros & Cons

| Pros | Cons |

| Cash advances based on hours worked | Small fee for instant payout |

| Flexible amount up to 50% of paycheck | Needs employer participation |

| Easy to use with fast payments | Only available for eligible jobs |

iOS Rating: 4.3

Android Rating: 4.8

7. Klover

Klover is another app like MoneyLion that lets you get up to $100 in cash advance. What makes it different is that it offers small tasks, like answering surveys or questions, to earn points.

The points you earn help determine if you can get extra cash. Once you complete enough tasks and gather enough points, you can use them to get money instantly.

Pros & Cons

| Pros | Cons |

| Earn cash by completing tasks | Cash advance limit is $100 |

| No interest or fees on advances | Requires time to complete tasks |

| Easy to use and flexible | Points system may delay cash |

iOS Rating: 4.7

Android Rating: 4.3

8. Affirm

Affirm is a popular app like MoneyLion, but it works a little differently. It lets you buy things now and pay for them later in easy installments.

With Affirm, you don’t need to pay the full amount upfront. The app has no hidden fees, no late charges, and no extra fines. Plus, its simple design makes it easy to use, which many users love.

Pros & Cons

| Pros | Cons |

| Pay for purchases in installments | Not a traditional cash advance app |

| No hidden fees or late charges | Limited to shopping purchases |

| Easy-to-use interface | Interest rates vary by loan |

iOS Rating: 4.9

Android Rating: 4.5

9. AfterPay

AfterPay is another app like MoneyLion that lets you buy now and pay later. You split your purchase into four equal payments, and you get your order right after making the first payment.

The app has useful features that help you manage your payments easily. This way, you don’t have to pay for everything at once, and paying the rest of the installments is simple and flexible.

Pros & Cons

| Pros | Cons |

| Pay in four easy installments | Only works for shopping purchases |

| Get your order after the first payment | Late fees apply if you miss payments |

| User-friendly and reliable | Not a cash advance app |

iOS Rating: 4.9

Android Rating: 4.8

The expert developers at The Hashtech are ready to help bring your mobile app idea to life. No matter what your concept is, get in touch with us today and start building the perfect app.Take Your App Idea Global

10. Avant

Avant is a helpful app for managing loans. It has smart features that let you track your payment history easily.

The app also sends reminders for upcoming payments and lets you make extra payments whenever you want. Avant works well on both Android and iOS devices and is simple for anyone to use.

Pros & Cons

| Pros | Cons |

| Easy loan management | May have higher interest rates |

| Payment reminders | Not a cash advance app |

| Available on iOS and Android | Loan approval process can take time |

iOS Rating: 4.8

Android Rating: 4.6

11. Axos

Axos Bank offers a service called Direct Deposit Express, which lets you access your paycheck up to two days early when you open an active checking account.

There are no fees or minimum balance requirements with Axos. The app also includes helpful overdraft protection, making it a solid alternative to traditional banks with modern features.

Pros & Cons

| Pros | Cons |

| Get paid up to 2 days early | Only available with Axos account |

| No fees or minimum balance | Limited to direct deposit users |

| Overdraft protection included | Not a cash advance app |

iOS Rating: 4.7

Android Rating: 4.4

12. Ingo Money

Ingo Money is a fast money app that makes it easy to cash checks, including business checks. You can also transfer money to your bank or digital accounts without any hassle.

To use apps like Ingo Money, you create an account and link your bank or PayPal account. After your profile is approved, you can upload a photo of your check. Once it’s approved, the money will be deposited into your account.

Pros & Cons

| Pros | Cons |

| Quick check cashing | Approval process can take time |

| Easy money transfers | Some fees may apply |

| Supports multiple account types | Lower Android app rating |

iOS Rating: 4.1

Android Rating: 3.8

13. Payactiv

Payactiv is an app that lets you access your earned wages before payday. It also offers financial advice and lets you pay bills directly from the app.

You can get a Payactiv debit card to make spending and managing your money easier. There’s a small $1 fee for some services, but direct deposit is completely free.

Pros & Cons

| Pros | Cons |

| Access your earnings early | $1 fee for some features |

| Bill payment and money management | Requires employer participation |

| Free direct deposit option | Debit card setup may take time |

iOS Rating: 4.8

Android Rating: 4.6

14. Possible Finance

Possible is one of the top apps like MoneyLion that offers short-term loans of up to $500. The interest rate depends on your state but usually ranges from 10% to 15%.

Each loan lasts for 2 months, with four easy payments spread over eight weeks. Once the loan is paid off, apps like Possible Finance report your payment history to the credit bureaus, which can help improve your credit.

Pros & Cons

| Pros | Cons |

| Borrow up to $500 in small loans | Interest rates vary by state |

| Flexible 4-part repayment plan | Only available in select states |

| Reports to credit bureaus | Loan approval may take some time |

iOS Rating: 4.8

Android Rating: 4.5

15. Wealthfront

Wealthfront is a smart app like MoneyLion that focuses on helping you save and invest your money. It also connects to your bank account, allowing you to get your paycheck up to two days early.

While it’s not a traditional cash advance app, Wealthfront helps you grow your savings and manage your finances better. It’s a great option if you’re looking for long-term financial tools and early paycheck access.

Pros & Cons

| Pros | Cons |

| Get paid up to 2 days early | Not meant for instant cash advances |

| Helps grow savings through investing | Requires linking a bank account |

| Great for long-term financial goals | Focused more on investment features |

iOS Rating: 4.8

Android Rating: 4.6

Apps Like MoneyLion: 10+ Other Options to Explore

If you are looking for apps like MoneyLion that can help you manage your money, get paid early, or even budget better, you’re in the right place. While MoneyLion is a popular choice, there are other great apps out there that offer similar features. Here are some alternatives that might also suit your needs:

- Even

- PockBox

- FlexWage

- B9

- LendUp

- ActiveHours

- DailyPay

- CashNetUSA

- Varo

- Digit

- Stash

- SoloFund

Each of these apps brings something different to the table. Whether you are looking for early pay, smart budgeting tools, or financial help, these apps have you covered. While they might not have the same exact features as MoneyLion, many of them offer similar services that could be useful for managing your finances.

What Are Cash Advance Apps?

Cash advance apps are mobile apps that let you get a portion of your paycheck before your payday. They send the money directly to your checking account, so you can use it when you need it most.

Many of these apps, like MoneyLion, offer the service for free, but some might charge a small fee. The best part? Most of these apps don’t charge interest, which makes them a better and cheaper option than payday loans.

Cash advance apps are great for handling short-term expenses. Even if there’s a small fee, the convenience and peace of mind they offer can make it worth it. They’re a smart choice compared to high-interest credit cards or payday loans.

Plus, these apps work on both iOS and Android phones, so you can easily download them and start using them right away. The money you borrow is simply paid back when you get your next paycheck.

How Do Cash Advance Apps Work?

Cash advance apps are a way to get quick access to money you’ve already earned, but haven’t been paid yet. They allow you to borrow a small amount of money before your next paycheck, making them useful when you need cash fast to cover bills or unexpected costs.

To use these apps, you typically need to sign up, give basic information about your job, income, and bank account. The app will then check your details, and if you qualify, you can borrow anywhere from $100 to $500 depending on your earnings.

The best part is that these apps offer a fast and easy way to get cash, without charging high interest rates like traditional loans. That’s why many people turn to them when they need money quickly.

Payday Loan Apps vs. Apps Like MoneyLion: Which One Is Better?

When comparing payday loan apps with apps like MoneyLion, they might seem similar at first, but they actually work in very different ways. Many people choose apps like MoneyLion because payday loan apps usually come with very high fees and strict rules that can make borrowing money expensive and hard to manage.

Payday loan apps are known for charging really high interest rates and having tough terms. This makes many people look for other options. Apps like MoneyLion, on the other hand, tend to be cheaper, easier to use, and don’t hit you with huge fees.

Team up with a top mobile app development company and turn your idea into a success. Connect with our experts today!Want to Build the Next Big App Like MoneyLion?

If you’re looking for a more affordable and flexible way to borrow money, apps like MoneyLion are often the smarter and safer choice.

How to Get a Cash Advance Fast

When money is tight, a cash advance can help you get through until your next paycheck.

To get started, choose a cash advance app and create an account. This is usually quick and done online by providing some basic details.

Here’s what you might need to provide:

- A valid ID (like a driver’s license or employee badge)

- Contact information (phone number, email, and home address)

- Bank account details for deposits and repayments

- Employer info and sometimes credit history

The required info may vary by app. Some apps approve you in minutes, while others might take a couple of days.

Once approved, you can request your cash advance. The money could arrive instantly, or within 1–2 business days, depending on the app.

How fast and reliable the process is depends on the app you choose.

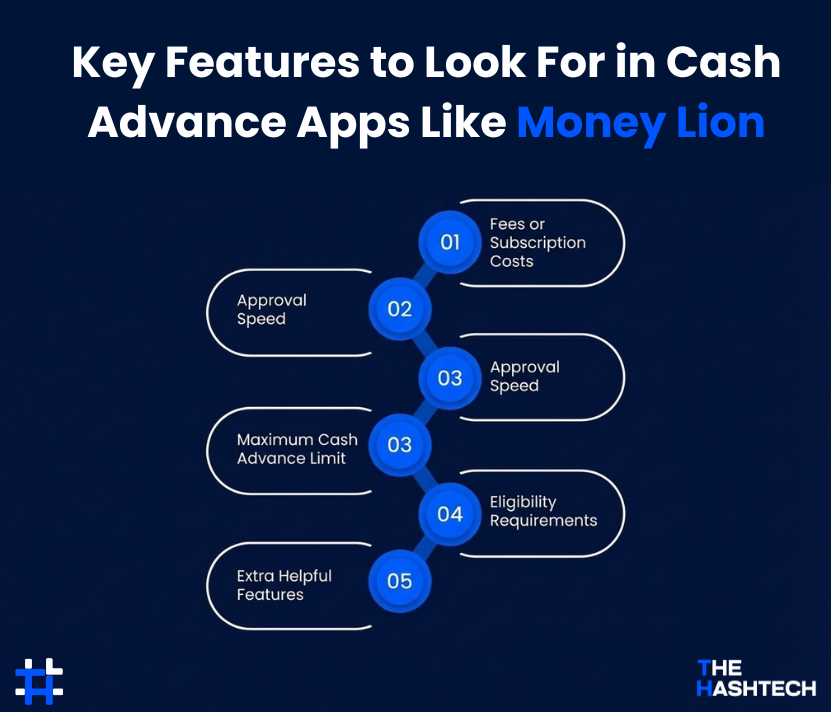

Key Features to Look for in Cash Advance Apps Like MoneyLion

The features in a cash advance app can make a big difference in how easy and helpful the experience is. While each app is different, here are some important features to consider when choosing an app like MoneyLion:

- Fast approval process

- Low or no fees

- Access to your paycheck early

- Low or no interest rates

- Easy-to-use design

- Strong privacy and security

- Helpful customer support

- Tools for building credit

- Options for paying bills or budgeting

These features not only help you get money fast but also make it easier to manage your finances and keep everything secure.

1. Fees or Subscription Costs

Before using a cash advance app, check if there are any fees. Most apps don’t charge much, but some might ask for a small subscription fee. This can be anywhere from $1 to $15, depending on the app and what features it offers.

2. Approval Speed

How quickly your application gets approved is another key feature to consider. The faster the approval, the better your experience. Some apps approve requests almost instantly, while others may offer faster approvals through premium plans.

3. Maximum Cash Advance Limit

When picking a cash advance app, it’s important to know the maximum amount you can borrow. Most apps let you borrow between $100 and $500. The exact limit you’ll get depends on a few factors, which you’ll discover after using the app.

4. Eligibility Requirements

Not everyone can get a cash advance. Each app has its own rules. Typically, you need to be a US resident and at least 16 years old. Other requirements may include having a certain credit score, proof of employment, and more.

5. Extra Helpful Features

In addition to the main features, look for other useful tools. These can include banking options that make it easier to manage your money and use the app more efficiently.

How Apps Like MoneyLion Are Changing How We Borrow Money

In the past, if you needed quick cash, payday loans were the go-to option. But today, more and more people are turning to smarter and safer ways to borrow money, like cash advance apps such as MoneyLion.

So, what makes these new apps better than payday loans? Here’s why they’re becoming so popular:

No interest on advances

Unlike payday loans, which charge crazy high interest, apps like MoneyLion offer cash advances with no interest.

Flexible repayment options

You can pay back what you borrow in smaller, easier-to-manage payments, instead of one big lump sum.

Built-in budgeting tools

These apps often come with tools that help you manage your budget, track spending, and save money all in one place.

Instant connection to your bank

You can link your bank account easily, so the process is fast and simple.

Financial advice & credit-building support

Some apps offer advice on how to improve your financial habits and even help you build a better credit score over time.

The best part? These apps make it easier for you to borrow money without putting your finances at risk. They look at your income and spending habits to make sure any cash advance you get is manageable and won’t hurt your credit score.

It’s all about giving you more control over your money and helping you make better choices for your financial future. So, if you need a quick cash advance, using an app like MoneyLion can be a better option than the old payday loan system.

Our experts at The Hashtech are here to help build the perfect mobile app that can generate great revenue. Reach out to us, and we’ll make sure your idea becomes a success.Ready to Create Your Own Finance App?

Final Thoughts

Cash advance apps are a great solution for people who sometimes run out of money before their next paycheck. They let you cover urgent expenses without the high-interest rates and fees of traditional loans.

In this article, we highlighted 25 apps that can help you manage your money better and make smarter spending choices.

Apps like MoneyLion can give you quick cash for short-term money problems until payday. However, keep in mind that these apps aren’t meant to be a long-term solution. The key to financial stability is understanding your income and expenses.

If you often find yourself low on cash, it’s a good idea to take a closer look at your spending. Cutting back on unnecessary expenses can help you save more and reduce the need to borrow money in a pinch.

There are plenty of apps out there to support your financial needs, or if you have a unique idea in mind, you can always partner with an app development company to create one. Just pick your niche, refine your idea, and start building!

Frequently Asked Questions (FAQs)

What’s the MoneyLion app for?

MoneyLion is a mobile app that lets you borrow up to $250 quickly, without paying any interest. It’s perfect for covering small bills or unexpected costs until your next payday.

Are apps like MoneyLion safe?

Yes, apps like MoneyLion are generally safe to use as long as you download them from reliable app stores and follow security tips. Make sure to check user reviews and the permissions the app asks for before you start using it.

Do these apps charge fees?

Most apps don’t charge any fees or interest. Some may offer extra paid features or ask for small optional tips, but overall, they’re much cheaper than payday loans.

What do I need to qualify for a cash advance?

To qualify, most apps will ask for:

- A valid ID

- A checking account

- Proof of income

- Regular direct deposits

Each app might have its own specific requirements, but these are the basics.

How are apps like MoneyLion different from payday loans?

Apps like MoneyLion don’t charge high interest or keep you stuck in debt. They often come with extra features like budgeting tools or financial advice. On the other hand, payday loans usually have very high fees and strict repayment rules.

Is there a limit to how much I can borrow?

Yes, most apps allow you to borrow between $100 and $500, depending on factors like your income and account activity.

Can I create my own cash advance app?

Yes, you can! If you have an idea for an app, you can team up with mobile app developers to make it happen. The market for these apps is growing and has a lot of potential.