How to Create an Instant Loan App Like CashNow?

19 January, 2026

The fintech industry is currently defined by the demand for being fast and reliable. As users move away from traditional banking toward instant digital solutions, apps like CashNow have set a new standard for how loans are disbursed within minutes, without long approval times or visiting a bank.

If you plan to create a loan app similar to CashNow, user trust and security should be your top priority. A well-built instant loan app offers smooth financial services along with strong security features, making users feel safe while using the platform.

One common question businesses ask is: “How much does it cost to create a loan app like CashNow?”

The development cost depends on several factors such as app features, level of complexity, technology stack, AI usage, and the location of the development team.

- Basic Implementation: A basic loan app with essential features usually costs between $20,000 and $40,000 (AED 73,450 to AED 146,900).

- Advanced Solutions: If you want a more advanced version, the cost can range from $40,000 to $180,000+ (AED 146,900 to AED 661,050). These advanced apps often include AI-based credit scoring, better fraud detection, and modern security features.

This guide explains how to create a loan app like CashNow. It also covers important features, technology choices, and estimated development costs.

Is creating such an app worth the investment? Yes, with the growing demand for instant digital loans, it can be a smart and profitable move.

Let’s get into the details!

Our experienced developers add customized features that improve performance and user experience.Create Your Loan App with Smart, Custom Features

What Is an Instant Loan App?

An instant loan app is a mobile app that helps users apply for and receive personal loans quickly. It removes the need to visit a bank or complete long paperwork. These apps are designed to make borrowing easy and stress-free for everyone.

After installing an instant loan app, users can register by entering basic details like their name, identity proof, and income information. Since everything happens online, the process is fast, paperless, and doesn’t involve long waiting times.

This is the reason businesses are now creating instant loan apps like CashNow. Partnering with specialized mobile app development company in Dubai, they build next-generation fintech apps that are useful for people who want quick funds without dealing with traditional banking steps.

Loan Lending App Market Overview

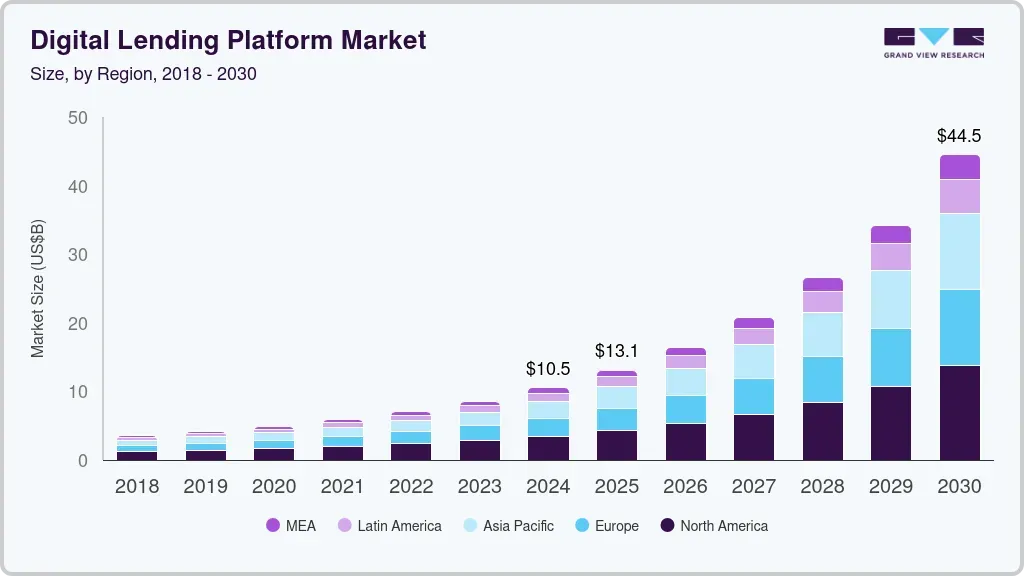

The global market for digital loan lending apps is growing rapidly. In 2024, the market value was around USD 10.55 billion. Experts expect this number to rise significantly in the coming years.

By 2030, the digital lending market is expected to reach nearly USD 44.49 billion, growing at a strong annual rate of about 27.7%. This growth shows the increasing demand for online and instant loan solutions worldwide.

Around 85% of traditional banks now work with digital lending platforms to improve convenience and reach more customers. At the same time, 72% of millennials choose digital lenders because they are faster and easier to use.

With the help of AI and machine learning, loan approval times have been reduced by up to 65% compared to old-style loan checks. Digital lenders also save money on operational costs, which allows them to offer interest rates that are 1.5% to 2.5% lower than those of traditional banks.

In 2025, nearly 55% of small and medium-sized businesses (SMEs) in developed countries relied on digital lending to cover cash flow gaps and manage working capital needs.

Now, let’s take a closer look at how the CashNow app works. Understanding this process will help you better evaluate the cost and effort required to create a modern lending app.

How Does the CashNow App Work?

The CashNow app is a digital lending solution that allows users to get personal loans quickly using their mobile phones. It is designed to help people handle short-term money needs without dealing with traditional bank processes.

Here’s how the CashNow app works step by step:

- Sign Up: Download the CashNow app and create an account by entering basic details.

- Apply for a Loan: After completing your profile, choose the loan amount and select a repayment period that fits your needs.

- Credit Check: The app uses smart technology and automated systems to review your credit profile.

- Loan Approval & Transfer: Once approved, the loan amount is sent directly to your linked bank account.

- Easy Repayment: You can repay the loan through the app using options like debit cards, online banking, or UPI.

Why Is the CashNow App So Popular?

The CashNow app is widely trusted as a reliable and fast loan platform. Many users prefer it because it offers quick loan approvals and an easy-to-use interface.

Its simple process and instant access to funds make it a convenient choice for people who need money without delays or complicated steps.

Key Features That Make CashNow a Top Loan App

- Interest Rates: CashNow offers annual interest rates between 25% and 36%, based on the borrower’s credit profile.

- Processing Fees: The app charges a simple 5% fee on the loan amount.

- Loan Amounts: Users can borrow from $5,000 up to $30,000 depending on their needs.

- Flexible Loan Terms: The app provides repayment options ranging from 91 to 180 days.

- Repayment Options: Borrowers can pick repayment durations between 65 and 120 days, making it convenient for different financial situations.

- Transparent Charges: CashNow is known for no hidden fees, ensuring users know exactly what they will pay.

Key Success Factors of the CashNow App

- Fast Approvals with AI: The app uses AI to review loan applications in seconds, cutting down traditional approval delays.

- Secure Integrations: Connections with credit bureaus and payment gateways make both loan approval and repayments safe and reliable.

- Strong Compliance: The app follows all regulations, helping maintain user trust and avoid legal problems.

- Scalable System: CashNow can support thousands of users at the same time without slowing down.

- Cross-Platform Access: Available on iOS, Android, and web, so users can manage loans anytime, anywhere.

An In-Depth Look at How to Create an Instant Loan App Like CashNow

The cost of developing a loan app like CashNow depends on several factors, such as the app’s features, complexity, and the technology used.

- Basic App: A simple lending app with essential features typically costs between $20,000 and $40,000 (AED 73,450 to AED 146,900).

- Advanced App: A more feature-rich app with AI-based credit checks, enhanced security, and advanced analytics can cost anywhere from $40,000 to $180,000+ (AED 146,900 to AED 661,050).

How Is the Cost Calculated?

The total development cost is influenced by the number of hours required and the developers’ hourly rates. The formula is simple:

Total Cost = Development Hours × Hourly Rate

For example, if the project requires 500 hours and the developer charges $50 per hour, the total cost would be $25,000.

The cost and time needed to build an app can differ from one provider to another. That’s why choosing the right mobile app development company is important for getting quality results within your budget.

Next, we will break down the development cost of a CashNow-like app based on complexity, development phases, and estimated timelines.

CashNow-Like Loan App Development Cost by Complexity

The cost of building a loan app like CashNow in the UAE depends largely on the app’s complexity. A simple app with basic features will cost less, while a more advanced app with AI, facial recognition, and extra integrations will be more expensive.

| Complexity Level | Description | Estimated Cost (AED) | Estimated Cost (USD) |

| Simple | Basic features for loan application and repayment | AED 73,450 – AED 146,900 | $20,000 – $40,000 |

| Medium | Additional features, API integrations, better UI/UX | AED 146,900 – AED 250,000 | $40,000 – $80,000 |

| Complex | Advanced features, AI/ML, facial recognition, high security | AED 250,000 – AED 5,000,000+ | $80,000 – $1,800,000+ |

As the features and technology become more advanced, the development cost increases accordingly.

Cost to Develop a Loan App Like CashNow by Development Stage

Creating a loan app involves multiple stages, from initial planning to maintenance. Each stage adds to the total cost, depending on how advanced and customized the app is.

| Development Stage | Estimated Cost (AED) | Estimated Cost (USD) |

| Ideation & Planning | AED 7,500 – AED 18,500 | $2,040 – $5,035 |

| UI/UX Design | AED 15,000 – AED 37,000 | $4,080 – $10,080 |

| App Development | AED 75,000 – AED 185,000 | $20,400 – $50,270 |

| Quality Assurance (QA) | AED 18,500 – AED 37,000 | $5,035 – $10,080 |

| Deployment & Maintenance | AED 11,000 – AED 37,000 annually | $2,995 – $10,080 annually |

The final cost will vary depending on the app’s features, complexity, and the development team you choose.

How Long Does It Take to Create an App Like CashNow?

The time to develop a loan app like CashNow usually ranges from 2 to 9 months, depending on the app’s complexity. Simple apps can be ready in 2 to 4 months, while advanced apps with AI, facial recognition, and multi-platform support may take 4 to 9 months to design, build, and test.

| Development Stage | Estimated Duration | Description |

| Planning & Research | 2-4 weeks | Setting project goals and understanding what users need. |

| UI/UX Design | 4-6 weeks | Creating easy-to-use and engaging app interfaces. |

| Frontend & Backend Development | 3-6 months | Building the core app, integrating all features, and connecting with systems. |

| Quality Assurance & Testing | 3-5 weeks | Checking performance, security, and compliance to ensure a reliable app. |

| Deployment & Feedback | 1-2 weeks | Launching the app and collecting user feedback for improvements and updates. |

Partnering with a trusted fintech app development company ensures your project stays on track. They can provide accurate cost estimates and timelines based on your app requirements.

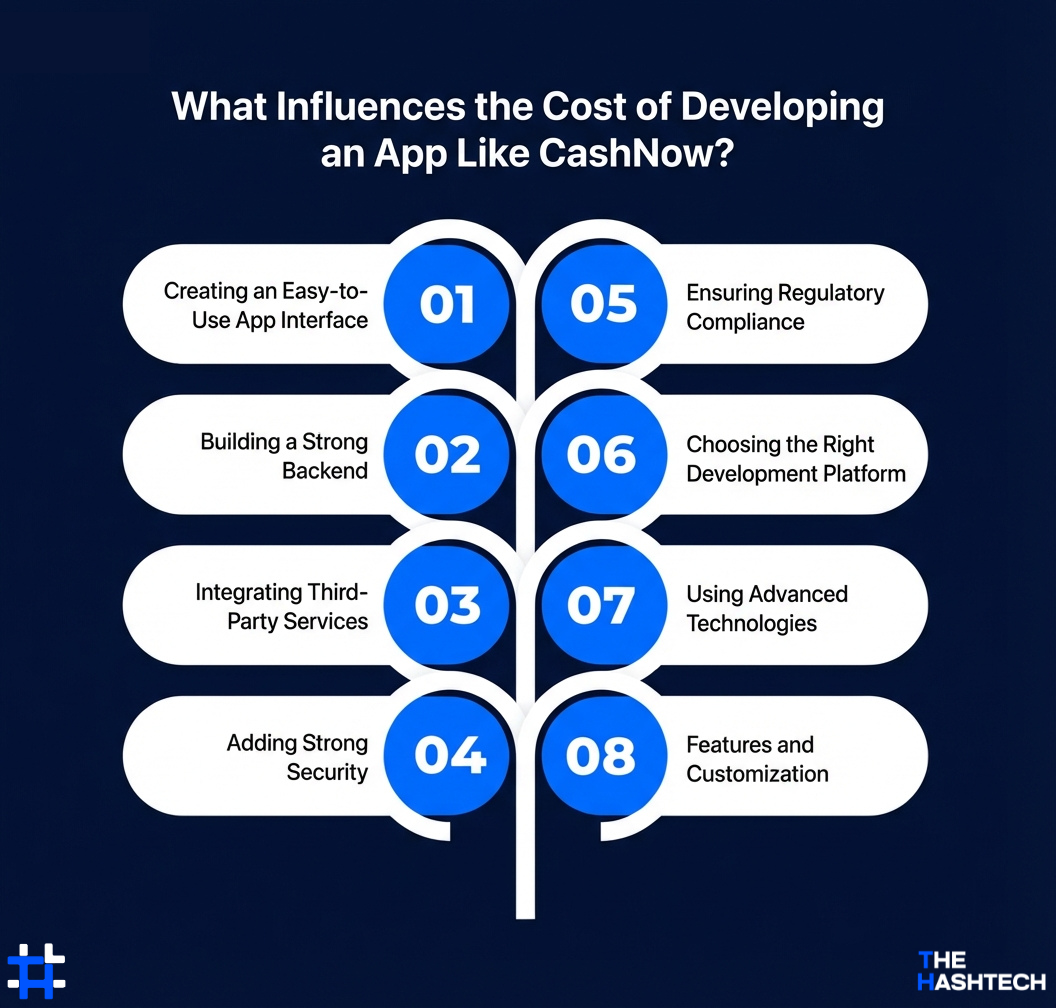

What Influences the Cost of Developing an App Like CashNow?

The price of creating a loan app like CashNow depends on several key factors that determine its performance and long-term success. Each factor affects how scalable, secure, and user-friendly the final app will be. Let’s look at the main elements that impact the development cost:

1: Creating an Easy-to-Use App Interface

A simple and attractive interface is essential for keeping users engaged. Developers spend time making sure the app is easy to navigate, visually clear, and fast for loan applications. The more smooth and personalized the experience, the higher the design costs may be.

| Design Stage | What It Includes | Cost Impact |

| Wireframing | Basic app structure and layouts | Low |

| UI Design | Visual style, colors, branding | Medium |

| UX Optimization | App flow, navigation, feedback loops | Medium |

A well-planned interface ensures users can apply for loans quickly and effortlessly, which increases app adoption and satisfaction.

2: Building a Strong Backend

The backend is the heart of any loan app. It handles user data, authentication, transaction records, and server communication. Developing a secure and reliable backend requires experienced developers and robust infrastructure.

The complexity and security of the backend can greatly affect the overall cost of building a finance app like CashNow.

3: Integrating Third-Party Services

A loan app needs to work with external systems like credit bureaus, payment gateways, email/SMS services, and identity verification tools. These integrations make processes smoother but can add extra development time and sometimes licensing costs.

| Service Type | Examples | Cost Impact |

| Payments | Stripe, PayTabs, Razorpay | Low |

| KYC & Identity Verification | Onfido, Jumio | Medium |

| SMS/Email OTP | Twilio, SendGrid | Low |

Using these services ensures secure transactions, verified users, and faster communication, which improves user trust and app performance.

4: Adding Strong Security

Loan apps handle sensitive financial and personal data, so keeping this information safe is critical. Features like data encryption, multi-factor authentication, and secure payment processing are essential. The more advanced and thorough the security measures, the higher the development cost for an app like CashNow.

5: Ensuring Regulatory Compliance

Digital lending apps must follow financial rules and regulations in every country they operate. This involves adding layers like KYC verification, data privacy controls, and audit tracking. Meeting these standards requires both technical know-how and legal expertise, which also impacts the overall development cost.

6: Choosing the Right Development Platform

The platform you choose Android, iOS, or both can have a big impact on the cost of building a loan app.

- Cross-platform frameworks like Flutter or React Native can save time and money while supporting multiple platforms.

- Native apps built separately for Android and iOS usually cost more but offer better performance and smoother user experience.

| Platform | Development Complexity | Cost Impact |

| Android or iOS (single platform) | Medium | Moderate |

| Both platforms (Native) | High | High |

| Cross-platform (Flutter/React Native) | Medium | Moderate |

Choosing the right platform depends on your budget, target audience, and desired app performance.

7: Using Advanced Technologies

Features like AI-powered credit scoring, automatic loan approvals, and real-time analytics make a loan app more efficient and trustworthy. These technologies enhance user experience and speed up processes, but they also increase the complexity and cost of developing a custom loan app.

8: Features and Customization

The cost of developing a loan app like CashNow also depends on how many features the app includes. Extra features like instant loan calculators, chat support, dashboards, and loan tracking make the app more useful for users but require more development and testing time.

| Feature Level | What It Includes | Cost Impact |

| Basic | User registration, loan requests, basic dashboard | Low |

| Intermediate | KYC verification, notifications, repayment system | Medium |

| Advanced | Chatbots, analytics, API integrations | High |

Creating a loan app like CashNow requires smart planning and the right technology choices. Balancing innovation with practicality helps control costs while ensuring long-term success.

Also Read: 25 Best Instant Loan Apps in the UAE

Hidden Costs of Developing an App Like CashNow

Building a loan app isn’t just about designing, coding, and launching. There are ongoing costs that many businesses often forget. These hidden expenses can affect profitability and app performance if they aren’t considered from the beginning.

Here are some common hidden costs to keep in mind when creating a loan app like CashNow:

1: Maintenance and Updates

Once your loan app is live, it needs regular updates to fix bugs, add new features, and stay compatible with the latest operating systems. Ongoing maintenance keeps the app stable, secure, and user-friendly, but it also requires a budget for developers and testers.

2: App Hosting

Your app needs a place to store data securely, usually on cloud services like AWS, Google Cloud, or Azure. These platforms are reliable, but hosting costs can increase as your user base grows, so it’s important to plan for this expense.

3: App Marketing and Promotion

Even a great loan app needs good visibility to attract users. Marketing efforts such as online ads, influencer partnerships, and app store optimization (ASO) are important, especially during the early stages. These activities involve ongoing costs that should be included in your budget.

4: Legal and Licensing Fees

Digital lending apps must follow financial regulations, data privacy rules, and licensing requirements in the regions they operate. Costs for legal advice, license applications, and renewals are often overlooked but are essential to stay compliant and maintain credibility.

Understanding these hidden costs helps businesses plan their budget better when building a loan app like CashNow.

How to Reduce Development Costs for an App Like CashNow?

Creating a loan app like CashNow doesn’t have to be expensive if you plan carefully from the start. Making smart choices early on can save money while keeping the app high-quality and fully functional.

Here are some practical ways to control development costs:

1: Launch a Minimum Viable Product (MVP)

Start with an MVP that includes only the core features. This allows you to test the idea with real users before building the full app. It saves money and provides useful feedback to improve the app.

2: Focus on the Most Important Features

Not all features need to be included at once. Prioritize the features that bring the most value to users. Extra features can be added later after the app gains users and starts generating revenue.

3: Choose Cross-Platform Development

Using frameworks like Flutter or React Native lets you build one app for both Android and iOS. This reduces development time and cost while keeping the app’s performance consistent across devices.

4: Hire an Experienced Development Team

Working with a skilled fintech development team can save both time and money. Experienced developers know how to balance legal compliance with app functionality, which helps avoid costly mistakes or rework later.

Having a clear plan and choosing the right development partner can turn your CashNow app idea into a reliable and efficient product without overspending.

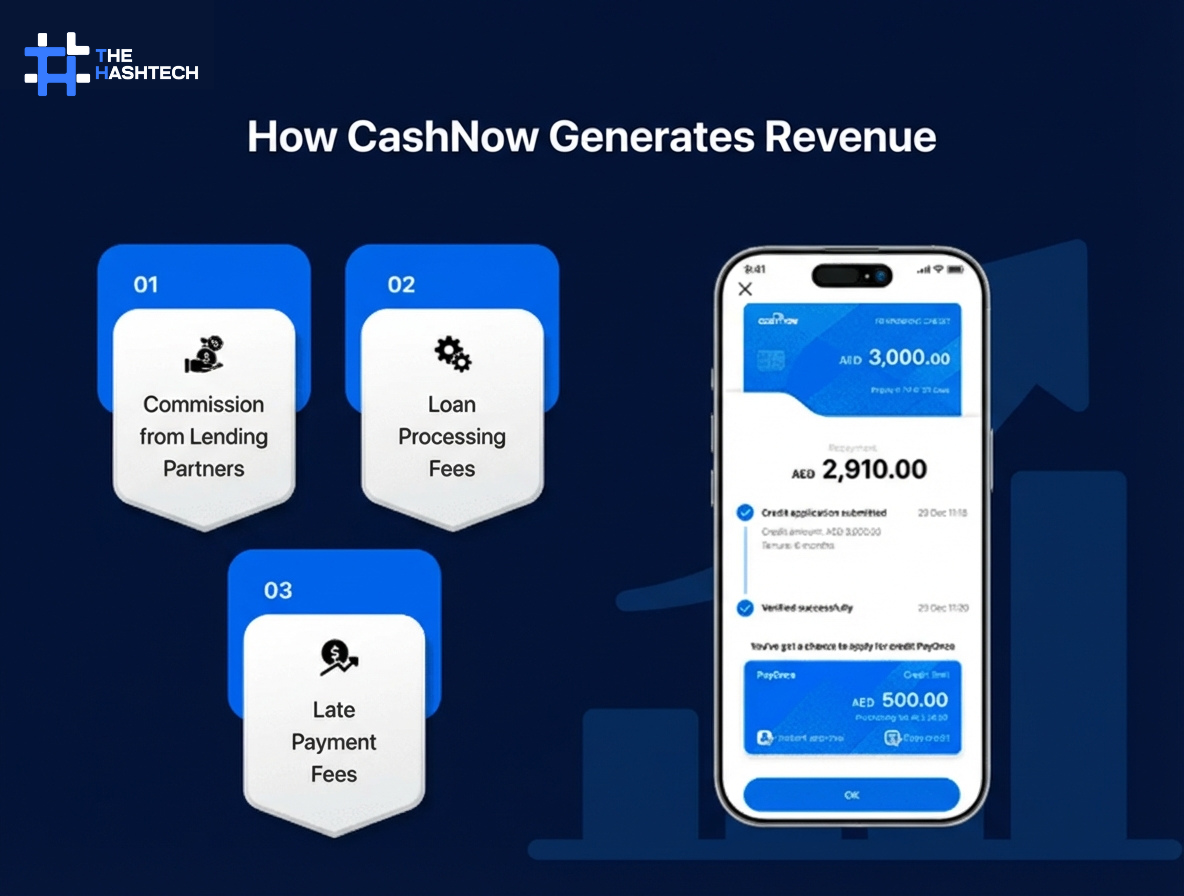

How CashNow Generates Revenue

A strong revenue plan is key to keeping apps like CashNow profitable while still delivering value to users. The app combines steady income sources with performance-based earnings, making its business model both sustainable and scalable.

1: Commission from Lending Partners

CashNow earns a commission from banks or lenders it works with. Every time a loan is successfully approved and disbursed through the app, a small percentage goes to CashNow as a service fee. This model links the app’s revenue directly to loan success.

2: Loan Processing Fees

The app charges a fixed processing fee on each loan, usually around 5% of the loan amount. This fee covers administrative tasks, identity checks, and digital paperwork. Collected upfront, it ensures a steady flow of income for the app.

3: Late Payment Fees

If borrowers fail to repay on time, CashNow charges a late fee. These fees encourage users to pay on schedule and also generate extra revenue. All charges are clearly shown to users, keeping the process transparent and trustworthy.

Get your loan lending app developed up to 10× faster while reducing costs by up to 40% with The Hashtech.Build Your Loan App Faster and at a Lower Cost

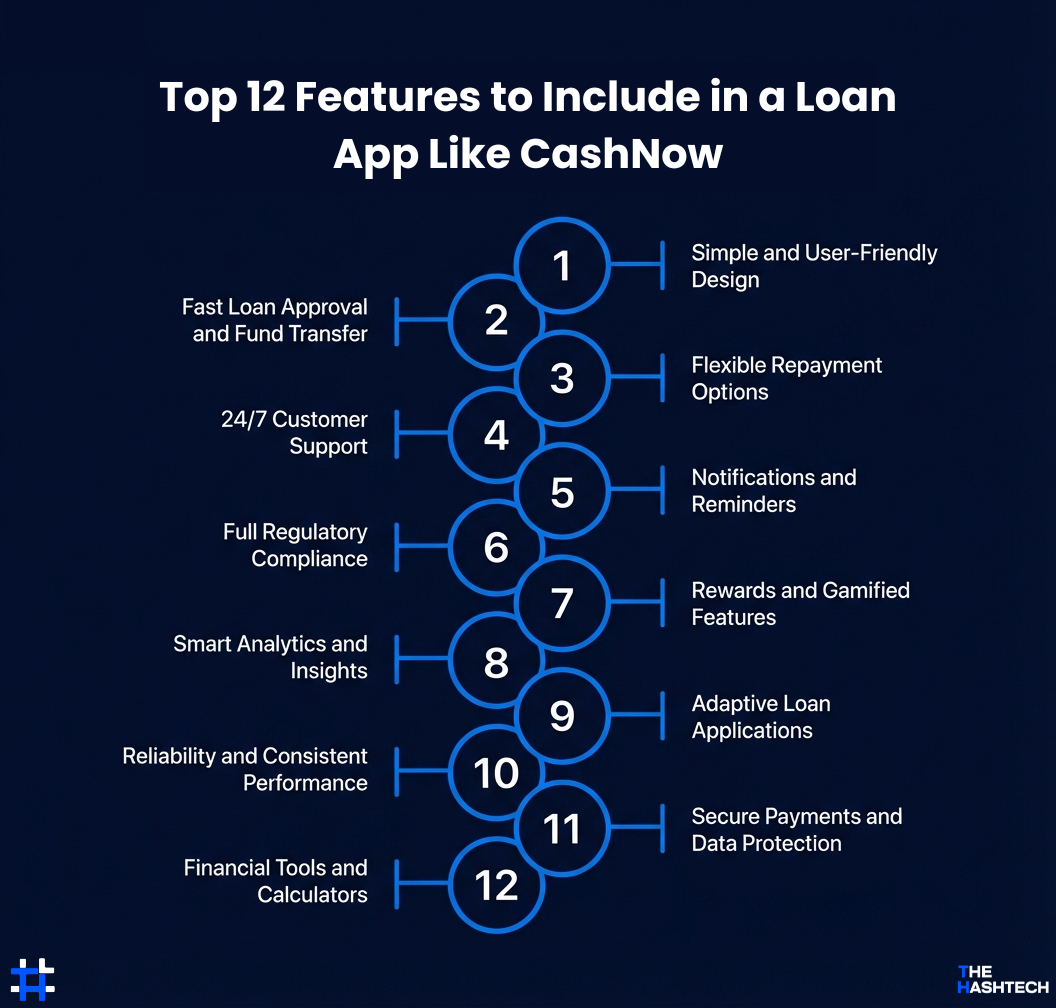

Top 12 Features to Include in a Loan App Like CashNow

A loan app like CashNow should have features that make borrowing quick, easy, and dependable. These features help build trust with users and encourage them to return for future loans.

1: Simple and User-Friendly Design

A clean and easy-to-use interface helps users navigate the app quickly. A good UI/UX reduces confusion, lets users apply for loans faster, and creates a positive first impression.

2: Fast Loan Approval and Fund Transfer

Apps like CashNow attract users with instant loan approvals and quick payments. Smart automation and credit checks allow users to receive funds within minutes, which is especially important during urgent situations.

3: Flexible Repayment Options

Users can choose repayment plans that fit their budget. The app can also allow partial payments, loan extensions, or early closures, making it more convenient and user-friendly.

4: 24/7 Customer Support

Offering around-the-clock support through chat, helpdesks, or AI chatbots makes borrowing smoother. Users feel more confident knowing they can get help anytime.

5: Notifications and Reminders

Push notifications for repayment dates, updates, or policy changes keep users informed. Timely alerts also reduce missed payments and help maintain good credit scores.

6: Full Regulatory Compliance

Following local financial laws and data privacy rules keeps users and the platform safe. Features like KYC checks, fraud prevention, and transparent loan terms build trust with users.

7: Rewards and Gamified Features

Reward users with loyalty points, discounts, or badges for timely repayments. Gamification makes using the app more engaging and encourages consistent financial responsibility.

8: Smart Analytics and Insights

Analytics help the platform understand user behavior, manage risks, and suggest personalized loans. Data-driven insights improve decision-making and app performance.

9: Adaptive Loan Applications

Dynamic forms that adjust based on user input make applications faster and simpler. Users answer only relevant questions, saving time and avoiding frustration.

10: Reliability and Consistent Performance

An app that works smoothly even during high traffic builds trust. Reliable uptime ensures users can access funds anytime they need.

11: Secure Payments and Data Protection

Security features like encryption, tokenization, and safe payment gateways protect sensitive data. Strong security is essential for maintaining user trust.

12: Financial Tools and Calculators

Built-in tools such as EMI calculators, credit estimators, and repayment planners help users understand loan details clearly. These features promote financial awareness and transparency.

Together, these features make a loan app fast, reliable, and easy to use, creating a platform that earns user trust and keeps them coming back just like CashNow.

Advanced Features of the CashNow App

The advanced features of CashNow make the app stand out. They improve user experience, ensure top-level security, and allow fast loan approvals. Here’s a list of key advanced features:

1: AI-Based Loan Risk Assessment

A major challenge for loan apps is figuring out if a borrower can repay on time. CashNow uses AI and machine learning to analyze multiple factors like income patterns, spending habits, and past credit behavior. This approach speeds up loan approvals while reducing the risk of defaults.

2: Facial Recognition for Identity Verification

Identity fraud is a serious issue in online lending. CashNow uses facial recognition technology to confirm a user’s identity instantly. This feature boosts security and builds user trust.

3: Smooth Digital Wallet Integration

CashNow allows users to receive loan funds instantly through popular digital wallets like Google Pay, Paytm, or Apple Pay. Users can also repay loans automatically via these wallets, making transactions faster and easier.

4: Instant Loan Approval and Fund Transfer

In today’s fast-paced world, speed matters. CashNow uses automated verification and AI-powered credit checks to approve loans in just a few minutes. Once approved, the money is transferred instantly, often in real time, helping users during urgent financial situations.

5: Direct Credit Bureau Integration

The app connects with national and international credit bureaus to quickly fetch and verify credit information. This makes lending more accurate and trustworthy, and users with a good credit history can enjoy faster approvals and better loan offers.

6: Flexible Repayment Options

CashNow offers customizable repayment plans so users can select tenure, EMI amount, and payment frequency that suits them. Whether someone prefers smaller frequent payments or a longer repayment schedule, the app adapts to their needs.

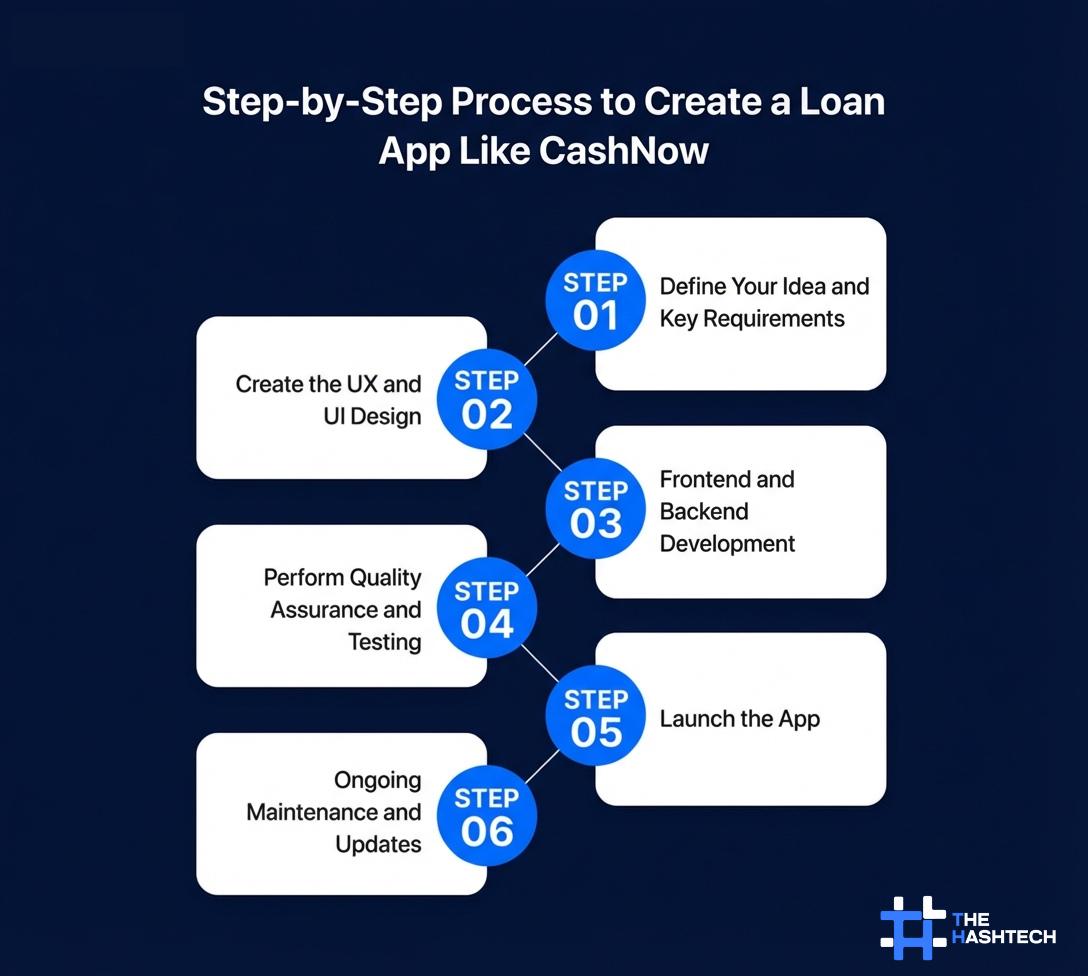

Step-by-Step Process to Create a Loan App Like CashNow

Creating a loan app needs careful planning and attention to user experience. Every stage of development is important to make sure the final app is useful, reliable, and easy to use.

Here’s a step-by-step guide to developing a loan app like CashNow in the UAE:

Step 1: Define Your Idea and Key Requirements

Every great app begins with a clear goal. First, decide what kind of loan app you want to create and who will use it.

Once the purpose is clear, list the main features and requirements for the app, such as user login, payment gateways, and credit assessment tools.

Step 2: Create the UX and UI Design

The app’s design is the first thing users notice, and it shapes their trust. Focus on creating simple, smooth flows with a clean interface. A good design helps users feel safe sharing their personal and financial information.

Step 3: Frontend and Backend Development

This is where the technical work happens. Frontend developers create what users see and interact with, while the backend handles data storage, loan processing, and user verification.

During this stage, the app is connected to APIs for credit checks, payment gateways, and KYC verification. Together, these systems make the app fast, reliable, and secure.

Step 4: Perform Quality Assurance and Testing

Before launching, the app must be thoroughly tested. Every feature should work smoothly on all devices and platforms. Testing checks for issues like crashes, slow performance, or incorrect data.

Security testing is critical for financial apps to ensure user data and transactions are fully protected. Only after passing these tests should the app move to launch.

Step 5: Launch the App

Once ready, deploy the app on the App Store and Google Play Store. Introduce it with clear messaging that highlights its benefits and builds trust. A soft launch can help gather early user feedback and fix minor issues before a full release.

Step 6: Ongoing Maintenance and Updates

App development doesn’t stop at launch. Continuous maintenance and updates are needed to keep the app secure, up-to-date, and user-friendly. This includes fixing bugs, adding new features, updating APIs, and ensuring compatibility with new OS versions. Monitoring user feedback and analytics helps improve the app based on real user needs.

Tech Stack for Creating a Loan App Like CashNow in 2026

Picking the right technology stack is a key step when creating a loan app. For an app like CashNow, the tech stack should allow fast loan processing, strong data security, and support for multiple platforms like Android, iOS, and web.

| Category | Technologies / Tools | Purpose |

| Frontend Development | React Native, Flutter, JavaScript, Dart, Material Design, Tailwind CSS | Build a smooth, responsive interface that works on both Android and iOS. |

| Backend Development | Node.js, Python (Django / FastAPI), Java (Spring Boot), Express.js | Handle user data, loan processing, and app logic efficiently. |

| Database | PostgreSQL, MongoDB | Store user profiles, transactions, and loan history. |

| APIs & Integrations | Experian, Equifax, TransUnion (Credit Check), Stripe, Razorpay, PayPal (Payments), Onfido, Trulioo, Signzy (KYC), Twilio, SendGrid (Notifications) | Connect the app to external financial systems, payment gateways, KYC verification, and notifications. |

| Security & Authentication | AES-256 Encryption, SSL/TLS, OAuth 2.0, JWT | Protect sensitive user data and ensure safe transactions. |

| Cloud Hosting & Storage | AWS, Google Cloud, Microsoft Azure | Host the app and manage scalability as users grow. |

| AI & Analytics | TensorFlow, Scikit-learn, Firebase Analytics, Mixpanel | Analyze loan risks, user behavior, and provide insights for better decision-making. |

| DevOps & Deployment | Docker, Kubernetes, Jenkins, GitHub Actions | Automate deployment and manage app updates efficiently. |

| Testing & QA | Selenium, Appium, Postman, JMeter | Ensure the app works correctly and performs smoothly. |

| Project Management Tools | Jira, Trello, Slack | Plan tasks, track progress, and coordinate the development team. |

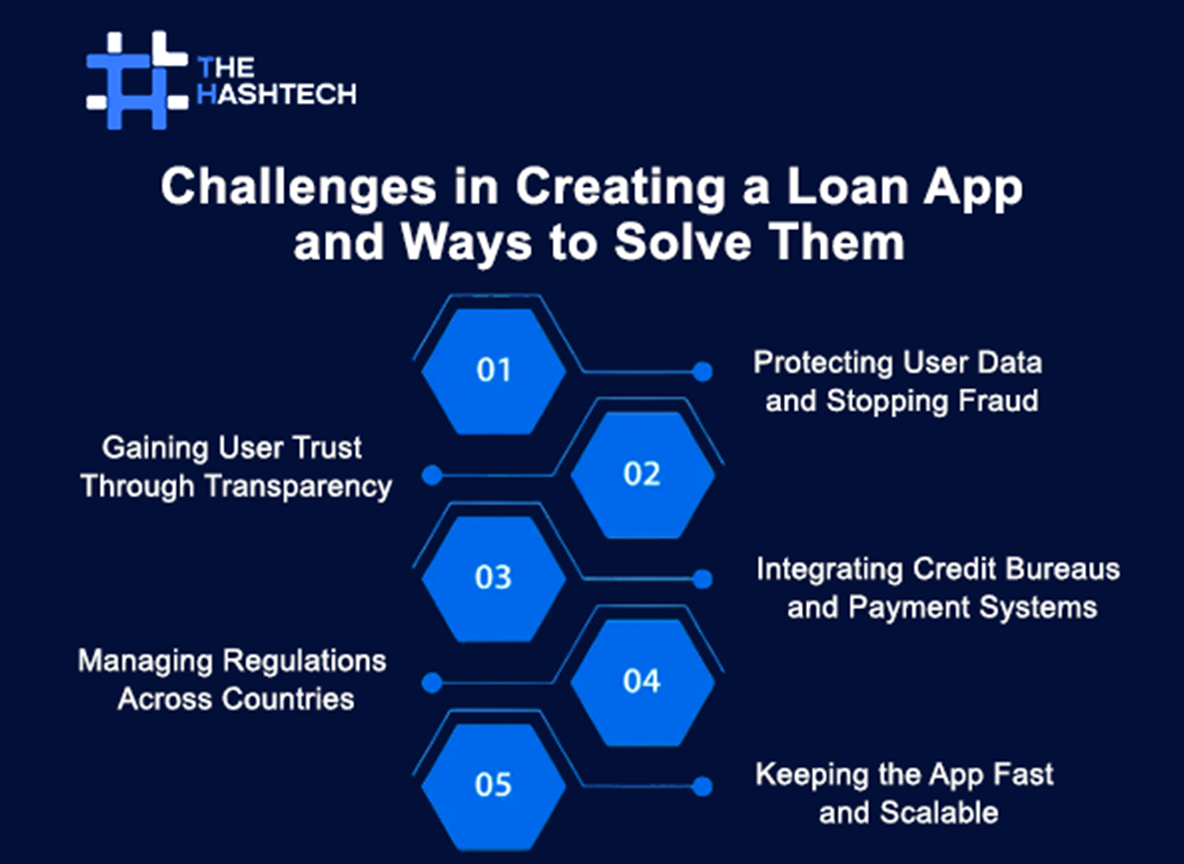

Challenges in Creating a Loan App and Ways to Solve Them

Creating a loan app like CashNow isn’t just about coding. There are several real challenges that need attention to make the app successful. Here’s a look at the most common obstacles and how to handle them:

1: Protecting User Data and Stopping Fraud

Problem: Security is a top concern for loan apps. These platforms store sensitive financial and personal information, so a data breach can harm users’ trust and cause legal problems.

Solution: Developers should use end-to-end encryption, multi-factor authentication, and real-time fraud detection. Regular security audits and relying on trusted cloud services help keep data safe.

2: Gaining User Trust Through Transparency

Problem: Users need trust to use a financial app. Hiding fees or unclear loan terms can lead to negative reviews and app uninstalls.

Solution: Show all charges, interest rates, and repayment details clearly. Add educational guides, FAQs, and chat support to make the app open and user-friendly.

3: Integrating Credit Bureaus and Payment Systems

Problem: Loan apps need to connect smoothly with credit bureaus and payment gateways for approvals and repayments. Different APIs, data formats, and rules can make this tricky.

Solution: Use standard API protocols and select partners with strong technical support. Build a testing environment to check integrations before launch, which reduces issues after the app goes live.

4: Managing Regulations Across Countries

Problem: Serving users in different countries can be tricky because each region has its own financial laws, covering lending limits, data privacy, and consumer protection.

Solution: Work with legal experts who know digital lending rules. Build the app with flexible compliance modules so it’s easy to update when laws change.

5: Keeping the App Fast and Scalable

Problem: As more users join, the app must stay fast and reliable. Slow interfaces or delayed loan disbursements can make users leave.

Solution: Use cloud infrastructure with auto-scaling and efficient backend frameworks. Employ monitoring tools to detect performance issues early and fix them before users notice.

Why Partner with The Hashtech for a Loan App Like CashNow

Creating a loan app like CashNow is not just about coding it’s about combining finance and technology to build trust with users. That’s where The Hashtech can help. With over 4 years of experience, we have assisted businesses worldwide in developing digital lending apps that are reliable and scalable.

One of our strengths is expertise in compliance and scalability. We understand both local and global regulations for digital lending, ensuring your app operates smoothly within the law.

Our developers focus on more than just building the app. We start with a detailed consultation to understand your business needs and design a solution that fits your goals perfectly.

We also believe in long-term support. After your app goes live, our team continues to monitor its performance, making sure it stays updated and meets market demands.

Next Step: Book a free consultation with us today to get a clear estimate and roadmap for your loan app project.

Get a personalized estimate that fits your business needs.Curious About the True Cost of Building a Loan App like CashNow?

Frequently Asked Questions

Q1: What is the process to create a loan app like CashNow?

To build a loan app similar to CashNow, you need to go through multiple steps. This includes designing the user interface, developing the frontend and backend, integrating payment gateways and credit bureau systems, adding security features, and performing thorough testing before launch. Working with an experienced fintech development team, like The Hashtech, can make the process faster and smoother.

Q2: How much does it cost to develop a loan app like CashNow?

The cost of developing a loan app like CashNow can range from $20,000 to over $180,000 (AED 73,450 to AED 661,050+). The total cost depends on factors such as the number of features, app complexity, chosen development platform, and the region of the development team.

Q3: How long does it take to develop a loan app like CashNow?

Developing a loan app like CashNow usually takes 3 to 8 months, depending on the app’s features and complexity. If you start with a basic MVP that includes only essential features, it can take about 12 to 16 weeks. A more advanced app with AI, analytics, and multiple integrations will need extra time for testing and optimization.

Q4: How can I lower the development cost of a CashNow-like app?

You can save costs by building an MVP first instead of developing all features at once. Using cross-platform frameworks like Flutter or React Native allows you to create a single app that works on both Android and iOS, reducing development time and expenses. Another smart approach is to outsource to an experienced fintech app development company like The Hashtech, which provides high-quality solutions at competitive prices.

Q5: How do loan apps like CashNow earn money?

Loan apps like CashNow make money through different income sources, including:

- Processing fees for every loan issued

- Commissions from partner banks or lenders

- Late payment charges if users miss repayment deadlines

Some apps also generate extra revenue through premium memberships or partnerships with insurance and financial services companies.

Q6: What are the main features of a CashNow-like app?

Key features that make a loan app reliable and user-friendly include:

- Easy-to-use interface and smooth user experience

- Quick loan approvals and fast fund transfers

- Flexible repayment plans to suit different users

- 24/7 customer support through chat or helpdesk

- Push notifications and reminders for repayments

- Compliance with financial rules and regulations

- High performance and uptime for a smooth experience

- Secure transactions and data protection

- Built-in financial tools like EMI calculators and credit estimators